USD/JPY Signal Update

Yesterday’s signal expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Entries can be taken before 5pm New York time, or from 8am Tokyo time to 8am London time (Wednesday).

Long Trade

Long entry following bullish price action on the H1 time frame after a first dip into the zone between 107.50 and 107.38.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit once the trade is 20 pips in profit and leave the remainder of the position to run ensuring there is no risk left in the trade.

USD/JPY Analysis

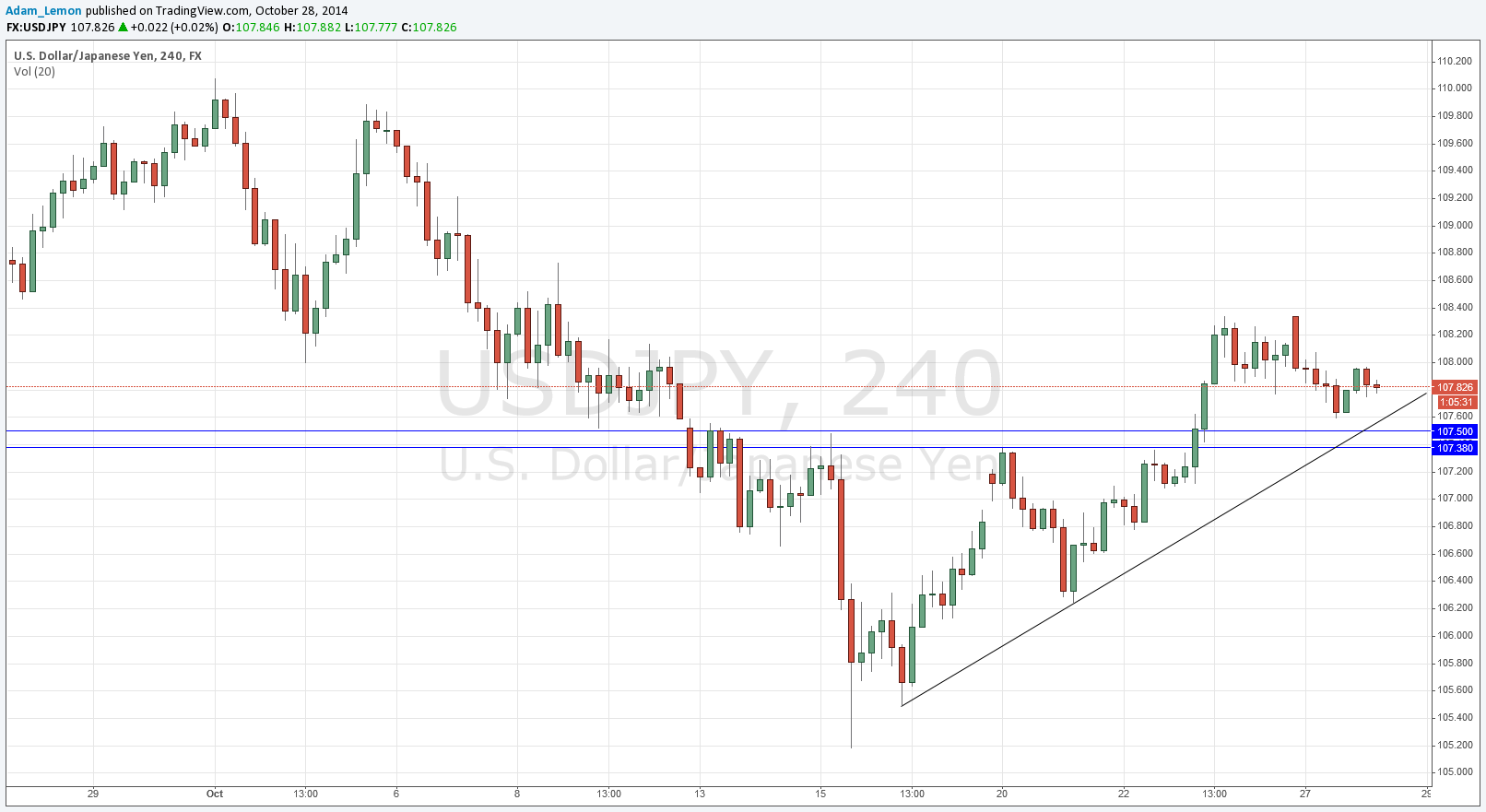

We still did not quite reach the supportive zone which begins below us at the key psychological number of 107.50, nor have we touched the short-term bullish trend line yet, both of which are logical places to look for a long trade, as shown in the chart below.

We did reach a weekly low of 107.59 towards the end of the New York session yesterday from which the price rallied, and although it did so without a great deal of conviction, it might turn out to be a low that holds for the remainder of this week.

The safest bet should be to wait for a bullish price action reversal off the supportive zone below, ideally in confluence with the trend line, and take a long trade there.

My colleague Christopher Lewis is also looking for a long trade.

There are high-impact data releases scheduled today concerning the USD, but there is nothing regarding the JPY. At 1:30pm London time there will be a release of U.S. Core Durable Goods Orders data, followed later at 3pm by CB Consumer Confidence. Therefore this pair is likely to be most active during the first half of the New York session.