USD/JPY Signal Update

Yesterday’s signal expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Entries may be taken before 5pm in New York, or from 8am Tokyo time to 8am London time (Thursday).

Take the risk off any trade open at 6pm London time before that hour arrives.

Long Trade

Go long following bullish price action on the H1 time frame after a first dip into the zone between 107.50 and 107.38.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit once the trade is 20 pips in profit and leave the remainder of the position to ride, ensuring there is no risk left in the trade.

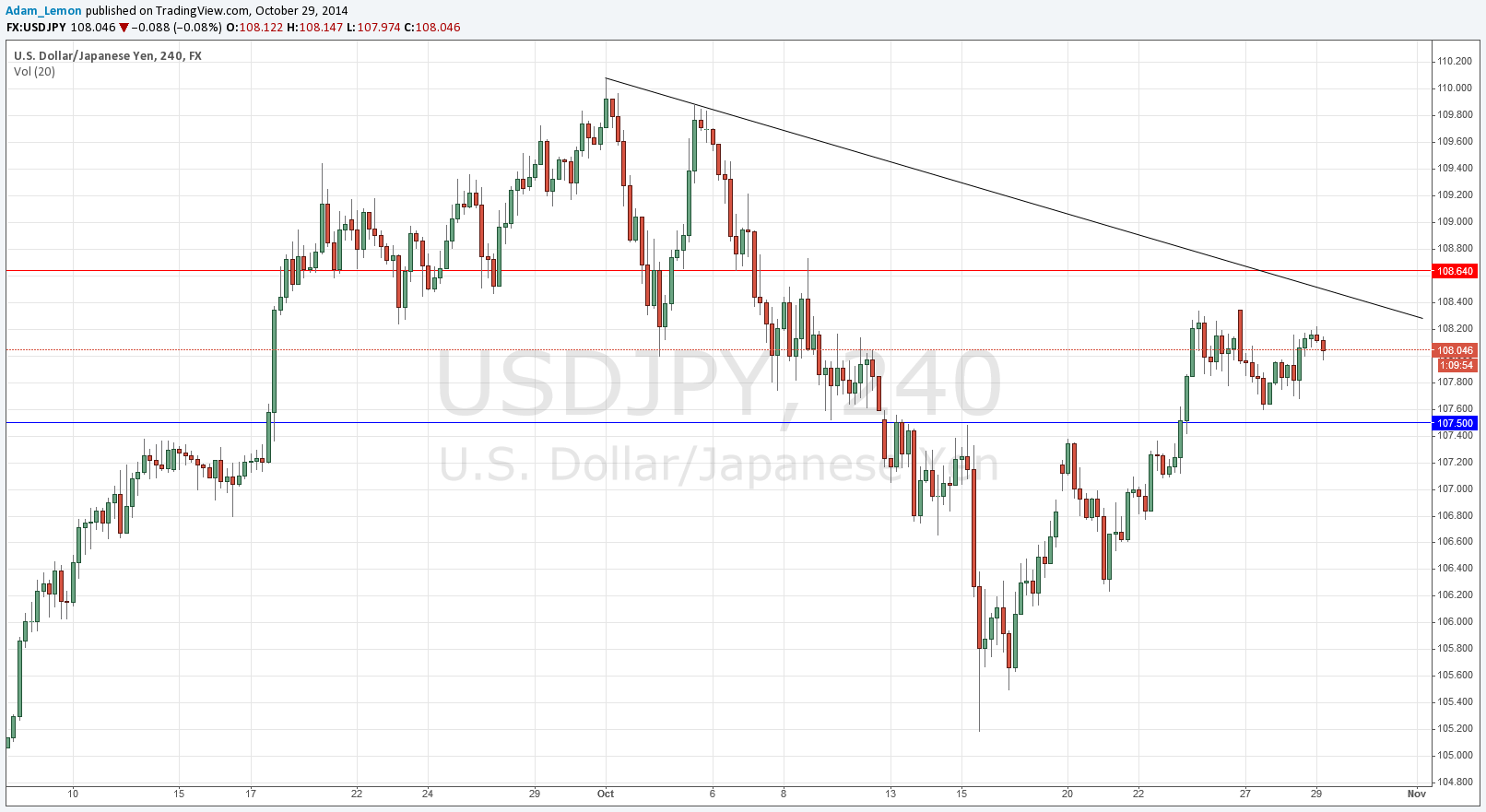

USD/JPY Analysis

The weekly low is still holding although it is plain to see that this is due really to JPY weakness rather than any continuing strength in the USD, which has gone a bit limp. The market is awaiting key USD announcements tonight not long after London closes and this moment is likely to give some fresh impetus to the USD one way or another. If it is bullish for the USD, we can expect this pair to soar upwards, as the weekly low easily held its own against yesterday’s spike down following the poor US data.

There is resistance overhead at 108.64 which is not too far away, and if the USD news is only slightly bullish this may hold. If it breaks there is no technical reason why the price should not continue up to the zone between 109.50 and the magic round number at 110.00.

There is a trend line above us but I doubt this will be very influential.

The best set-up might be if mildly bearish USD news later pushes this pair back down to the supportive zone, and then turns around giving a long trade.

There are high-impact data releases scheduled today after London closes concerning the USD, but there is nothing regarding the JPY. At 6pm London time there will be a release of the U.S. FOMC Statement and Federal Funds Rate. These are likely to have a significant impact upon the USD and so the pair may be relatively quiet during today’s London session.