USD/JPY Signal Update

Yesterday’s signal expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Entries must be made between 8am and 5pm in New York today, or later from 8am Tokyo time to 8am London time (Friday).

Long Trade

Short entry following bearish price action on the H1 time frame after a first touch of 110.00.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit once the trade is 20 pips in profit and leave the remainder of the position to run, ensuring there is no risk left in the trade.

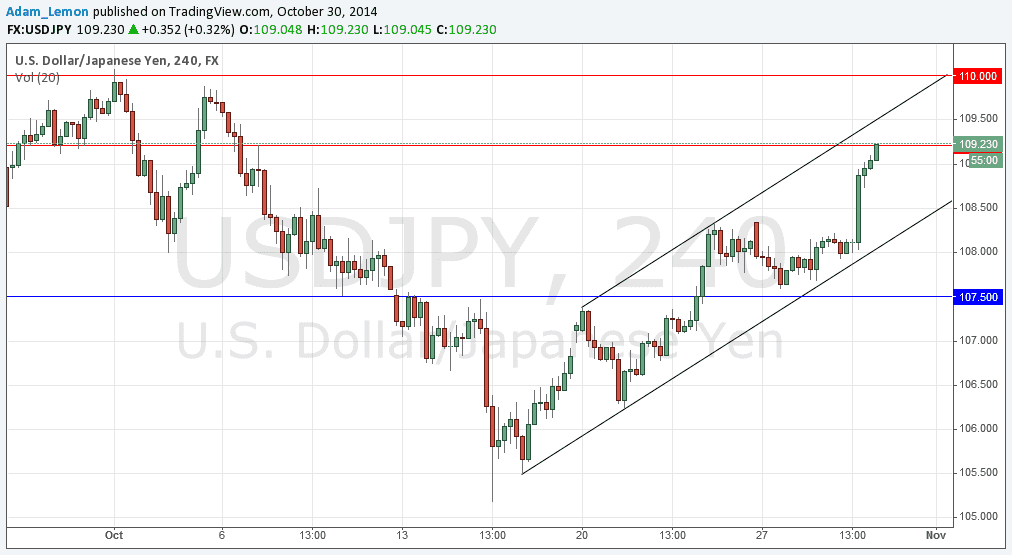

USD/JPY Analysis

This pair is again one of the kings if not the king of the Forex market, as renewed USD strength following yesterday's high-impact news combines with the continuing strong weakness in the JPY to push this price up to new highs. At the time of writing, we are only 80 pips away from the key resistance and psychological number of 110.00.

There have been good opportunities to get long at bullish candles at weekly lows both this week and last week that are currently paying nice dividends. However as we approach closer to 110.00 it would be prudent to think about taking at least some partial profit.

Turning to the technical picture, we are in a very symnetrical bullish channel, with key support below at 107.50 (note this week's low was only a few pips above 107.50).

At the time of writing we are sitting right on minor resistance at 109.21 which might possibly hold. Above that there is the upper channel trend line at about 109.50 and then finally 110.00. These are all areas we might see a temporary reversal. Between 109.50 and 110.00 we might see a major swing high from which the price pulls back significantly.

If we should make a triple top at 110.00 this could be good for a return to 107.50 so that would be a logical place at which to look for a short trade. We are too far away from likely support to be looking for new longs just yet. Those already long should be thinking about taking at least partial profits.

Towards the end of the Tokyo session there will be a release of the Bank of Japan’s monetary policy statement which is likely to affect the JPY. Regarding the USD, there will be key releases of Advance GDP and Unemployment Claims data at 12:30pm London time, followed by a speech by the Chair of the Federal Reserve half an hour later: these events are likely to affect the USD. It is likely to be an active day for this pair.