USD/JPY Signal Update

Last Thursday’s signal expired without being triggered.

Today’s USD/JPY Signal

Risk 0.75%

Entries must be made prior to 5pm New York time or from 8am Tokyo time until 8am London time tomorrow.

Long Trade

Long entry following bullish price action on the H1 time frame following a first touch of 109.13.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run. Ensure the risk is taken off the trade.

Short Trade

Short entry following bearish price action on the H1 time frame following a first touch of 110.00.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run. Ensure the risk is taken off the trade.

USD/JPY Analysis

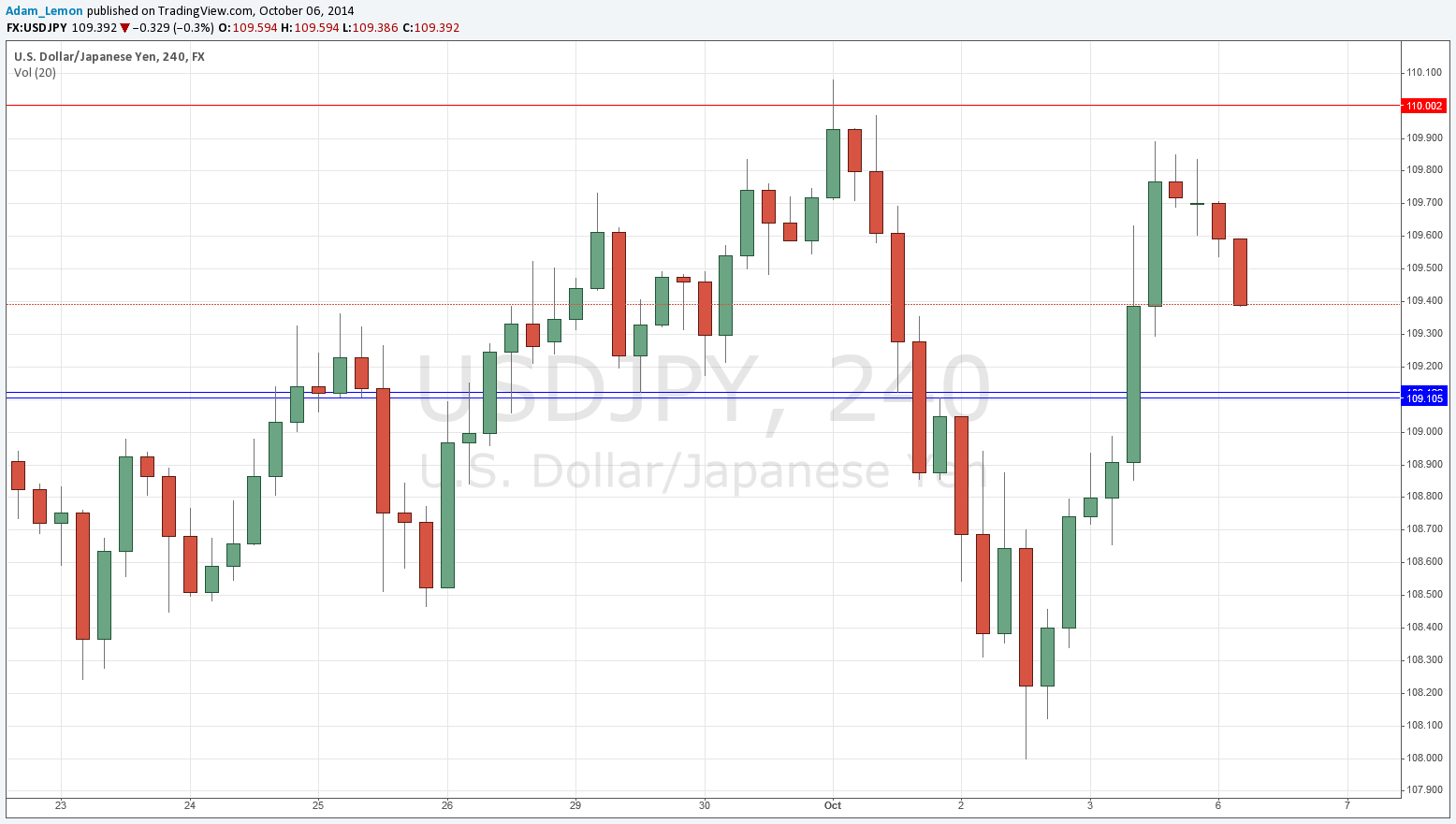

Although the USD roared and ahead and made new highs against several pairs after the NFP data was released on Friday, it is significant that it failed to beat the high made earlier in the week against the JPY. The 4 hour chart below shows a very bearish “falling off” candlestick pattern from Friday’s high, and the overall picture is suggestive of a bearish double top at around the psychologically key 110.00 level.

Therefore it seems clear that although the USD strength continues, this pair is unlikely to be the best vehicle for exploiting USD strength, and in fact the JPY was the only other currency apart from the USD to show any strength last week.

Having said that, there is a small flipping zone at around 109.13, so if there is a bullish reversal there, it may give some long pips. However, I think it is more likely that we will fall down to a point close to last week’s low.

An alternative scenario would be for the price to reverse bullishly very soon even before hitting 109.13. If we hit 110.00 first, this could give a good opportunity for a short off a triple top.

This pair is no longer the king of the market. That honour goes to the European currencies against the USD.

There are no high-impact data releases scheduled for today which are likely to directly affect either the JPY or the USD, although there may be an Interest Rate Statement from the Bank of Japan towards the end of the next Tokyo session. Therefore it is likely to be a quiet day for this pair, at least until such a statement may be made.