USD/JPY Signal Update

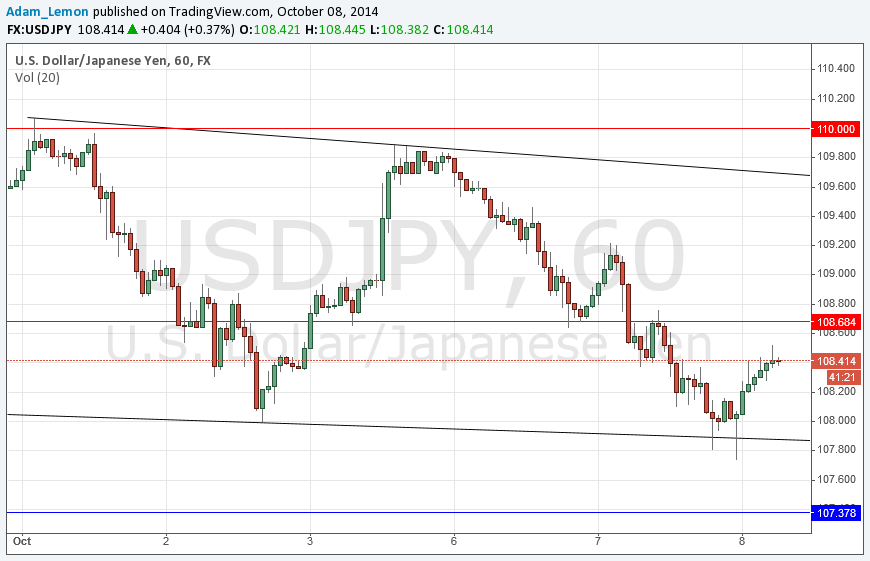

Yesterday’s signals were not triggered, as although we did hit the lower trend line for a long trade, the bullish price action that appeared did not do so on the first bounce, as stipulated. If you did enter after the pin bar on the H1 chart after the second bounce, it would be a good idea to exit with profit, which is showing at the time of writing.

Today’s USD/JPY Signal

Risk 0.75%

Entries can only be made from 8pm London time until the New York close, and then from 8am Tokyo time until 8am London time tomorrow.

Long Trade 1

Long entry following bullish price action on the H1 time frame following a first touch of 107.38.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run. Ensure the risk is taken off the trade.

Short Trade 1

Short entry following bearish price action on the H1 time frame following a first touch of 108.64.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to until it hits the lower trend line within the bearish channel. Ensure the risk is taken off the trade.

Short Trade 2

Short entry following bearish price action on the H1 time frame following a first touch of 110.00.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run. Ensure the risk is taken off the trade.

USD/JPY Analysis

Yesterday I gave a long signal that was looking for a bounce off the lower trend line of the wide descending channel that we are in. Following yesterday’s continued rise of the JPY and fall of the USD, we did get this bounce earlier during the Tokyo session today. It is too soon to say whether this move up is likely to continue, but it seems to be stalling at the time of writing. We also have some flipped support to resistance overhead now that has just formed at 108.68, which is a bearish sign. I doubt we will be able to penetrate that level upwards before the FOMC statement this evening, and it might even act as a good level for a short trade afterwards.

As we have already had a bounce up off the lower trend line, I would not be looking for another long there if we return there soon, but it could be a wide point to exit any short trades. If we fall to the area at around 107.50 – 107.38, I would look for a long trade there.

There are no high-impact data releases concerning either the JPY or the USD scheduled for today’s London session. Later, at 7pm London time, there will be a release of the U.S. FOMC Meeting Minutes which is likely to affect the USD. It might be a quiet day until then.