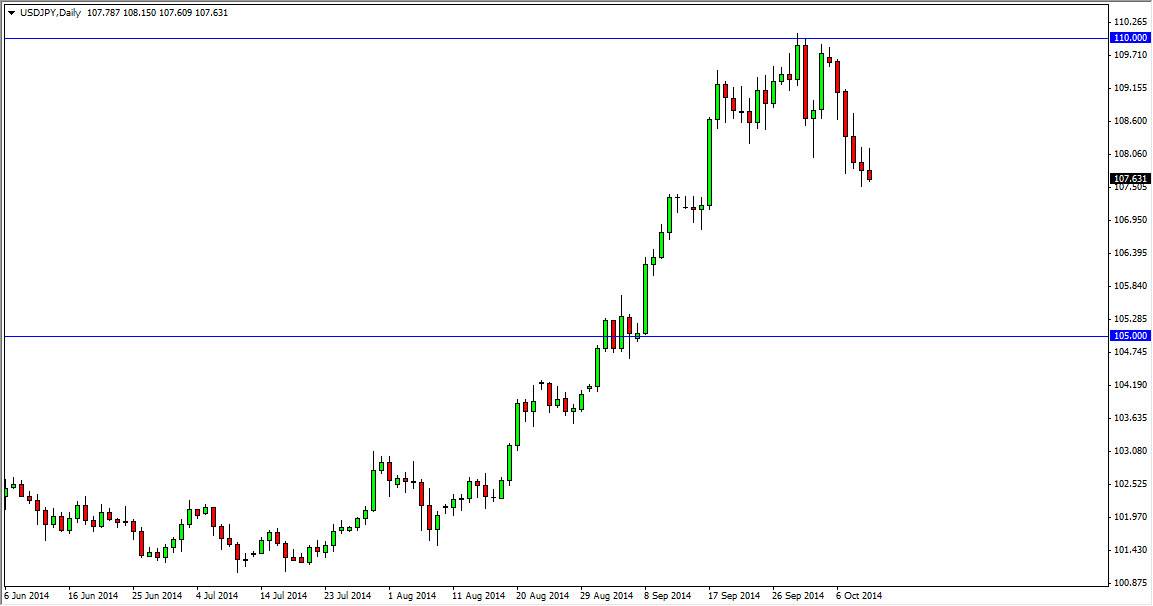

The USD/JPY pair has had a fairly rough week, and Friday continued the softening of the market. We tried to rally, but as you can see failed and ended up forming a shooting star. Because of that, the market looks as if it’s ready to continue going a little bit lower from here, but we do recognize that the 107 level is supportive. Even below there, we feel that the market should find plenty of support, as there are without a doubt significant amounts of buying areas all the way down to the 105 level.

The US dollar continues to be the strongest currency overall, and the fact that we have pullback here was probably a function of simple exhaustion at this point in time. After all, the market has broken out in a very impulsive manner, and that means that sooner or later we run out of momentum.

Because of this, the market simply had a pullback but I believe that we will find enough in the way of bullish pressure below to continue going higher, after all the Bank of Japan continues to work against the value of the Yen anyway. With that, it’s likely that the market will build up enough momentum to ultimately break above the 110 level, which would have the market looking for the next leg higher. I believe that we will see that, but we could fall as low as 105 before we build up enough momentum.

One-way trade

I believe that this is a one-way trade at the moment. You have the Federal Reserve looking likely to exit quantitative easing, which is essentially the same thing as tightening. On the other end of the spectrum, you have the Bank of Japan looking to more than likely expand its monetary policy, weakening the Yen over time.

With that, I believe that every time this market falls, it’s time to start looking at buying the US dollar as it would be considered to be a strong value. Ultimately, I think this market goes to the 150 level by the end of the year.