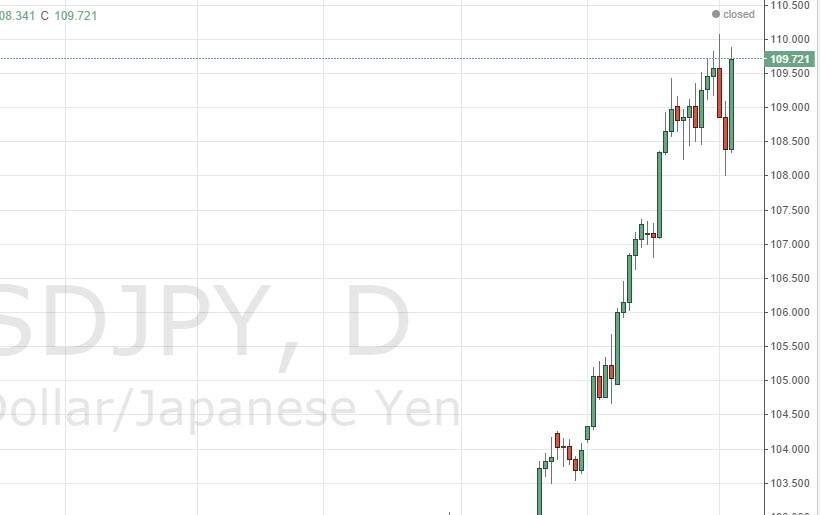

The USD/JPY pair rose again during the course of the session on Friday, as the nonfarm payroll numbers came out stronger than anticipated. With that being the case, the US dollar strengthened against most currencies, and as everyone knows this pair tends to react in a similar fashion as the nonfarm payroll numbers go, it’s not a big surprise that we went higher. However, we are just below the 110 level, an area that has been significant resistance and support in the past.

That being the case, the 110 level looks as if it could cause a bit of trouble, but ultimately I do think that we get above that level. After all, I believe that we have started a multi-year “buy-and-hold” type of phase for the longer-term traders, and as a result I think that a lot of big-money is buying this pair and simply holding onto it. However, short-term traders will continue to buy this pair and try to make money based upon every time it dips.

Massive uptrend.

Obviously, this pair is in a massive uptrend at this point in time. Because of that, we have no way to sell this pair, at least until we get below the 105 level which we see as the “floor” in this marketplace. It’s almost impossible to imagine this market dropping down below there, and anywhere between here and there I would be willing to buy supportive candles from time to time as the market simply has far too much in the way of bullish pressure.

The Federal Reserve will continue to taper off of quantitative easing, and in fact exit quantitative easing in the near future. This will continue to bring the value the US dollar higher in general, while the Bank of Japan continues to offer very loose monetary policy, making this a bit of a “perfect storm.” I have no idea how this pair would fall with any significance, barring some type of financial meltdown, which is not likely at this point in time. I believe that several careers will be made by going long of this pair.