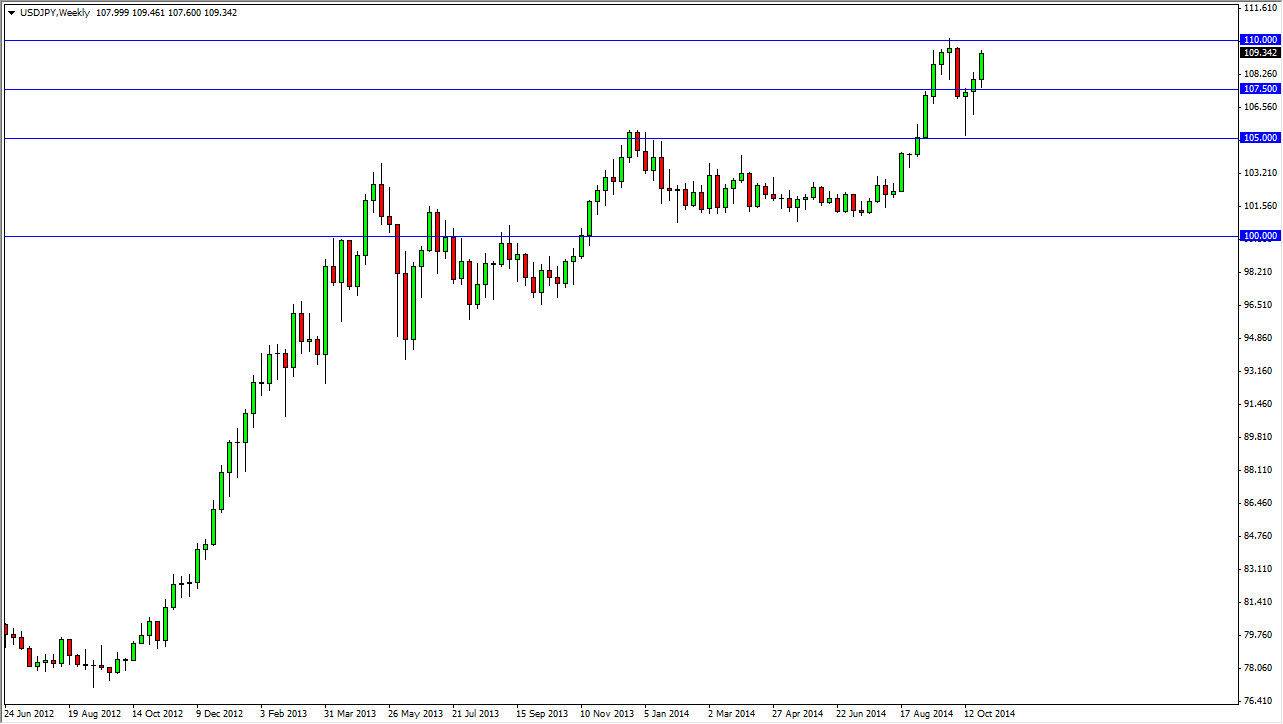

The USD/JPY pair has had a couple of the strong week see recently, after bouncing off of the important 105 level. The 105 level was an area of significant resistance previously, and the fact that we have gone back and tested that area for support is important. I believe that it has held significantly, and that we will in fact finally break out above the 110 level. A move above the 110 level signifies that we will begin our next leg higher, which means that we should go much higher levels given enough time.

I believe this is a longer-term uptrend that should continue for a couple of years, so therefore I have no interest whatsoever in selling this market. I also think that once we get above the 110 level, the market will then target the 115 level given enough time. Pullbacks at that point time should be buying opportunities, and treated as such. It’s only a matter of time before the Japanese yen completely crumbles against the US dollar as the Federal Reserve has gotten out of the quantitative easing game.

Bank of Japan

The Bank of Japan continues to keep very loose monetary policy, and quite frankly I would not be surprise at all to see that not only continue, for perhaps even expand. Remember, the Japanese economy is highly sensitive to exports and therefore needs to have a soft Yen in order to continue the economic growth that is so desperately needed.

We could pull back a little bit from the 110 level, but I believe that will simply be yet another buying opportunity. I firmly believe that the 110 level will be broken this month, so therefore every time we pullback, I believe that it will offer value in the US dollar the people will want to get involved with. I find it almost impossible to believe that we will break down below the 105 level, but if we somehow did I would think that we could sell at that point. However, I believe it would take some type of financial catastrophe to happen.