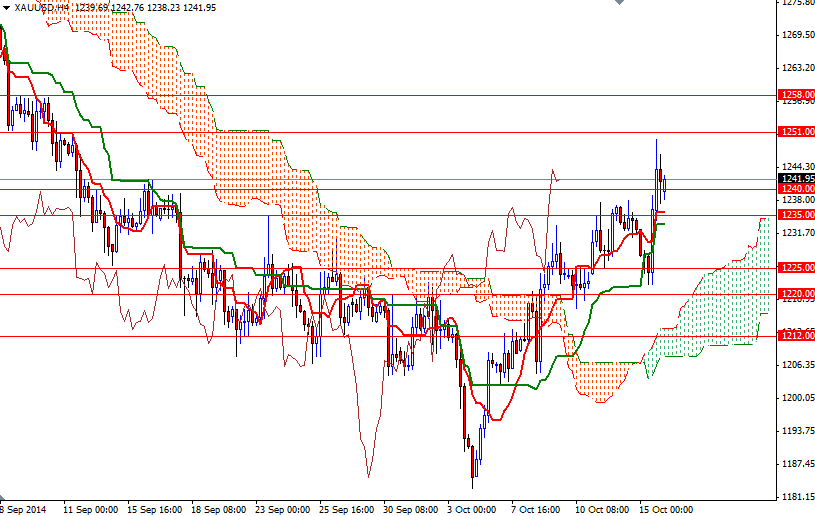

The XAU/USD pair (Gold vs. the American dollar) had a positive day as disappointing U.S. economic data and continued volatility in the global equities markets increased desire for safe haven diversification. The pair initially tested the $1225/20 support area but the market turned bullish and traded as high as $1249.60 after data released from the Commerce Department showed that retail sales decreased 0.3% in September. The Labor Department said that producer price index dropped 0.1% and the Federal Reserve Bank of New York reported that manufacturing in the region fell to 6.2 from 27.5 the prior month.

Apparently weaker-than-anticipated economic data released from the Unite States raised doubt over how quickly the U.S. Federal Reserve is going to start lifting interest rates and as a result markets are trying to reduce their exposure to long dollar positions. Speaking strictly based on the charts, it is possible that prices will continue its bullish tendencies and try to push through the 1251 resistance level - unless we go back below the 1235/2 area. If that is the case, I think the 1258 level will be the next stop.

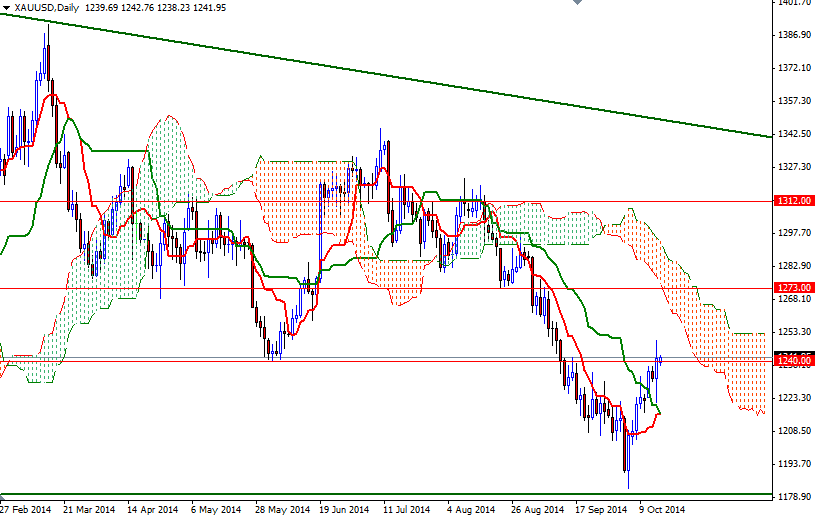

However, keep in mind that the Ichimoku cloud on the daily chart indicates an area of strong resistance and because of that I think the market will encounter significant pressure there. From an intra-day perspective, the bears will have to drag prices below the 1232 level if they intend to increase pressure. Closing below this support would suggest that the XAU/USD pair will retest the 1225/0 area. Today sees release of several important economic reports such as unemployment claims and industrial production, so expect some volatility.