USD/JPY

The USD/JPY pair fell during the course of the week, breaking the bottom of the hammer that had formed during the previous one. This technically makes that hammer a “hanging man”, which of course is a very negative sign. However, we have no interest in selling this market as we believe that the 105 level should be massively supportive. It was after all, the site of a significant breakout to the upside, and it has yet to be retested, thereby making a pullback to that area actually a very positive thing as long as we see support. With that, we are buying supportive candles below as we anticipate the market will go much higher given enough time.

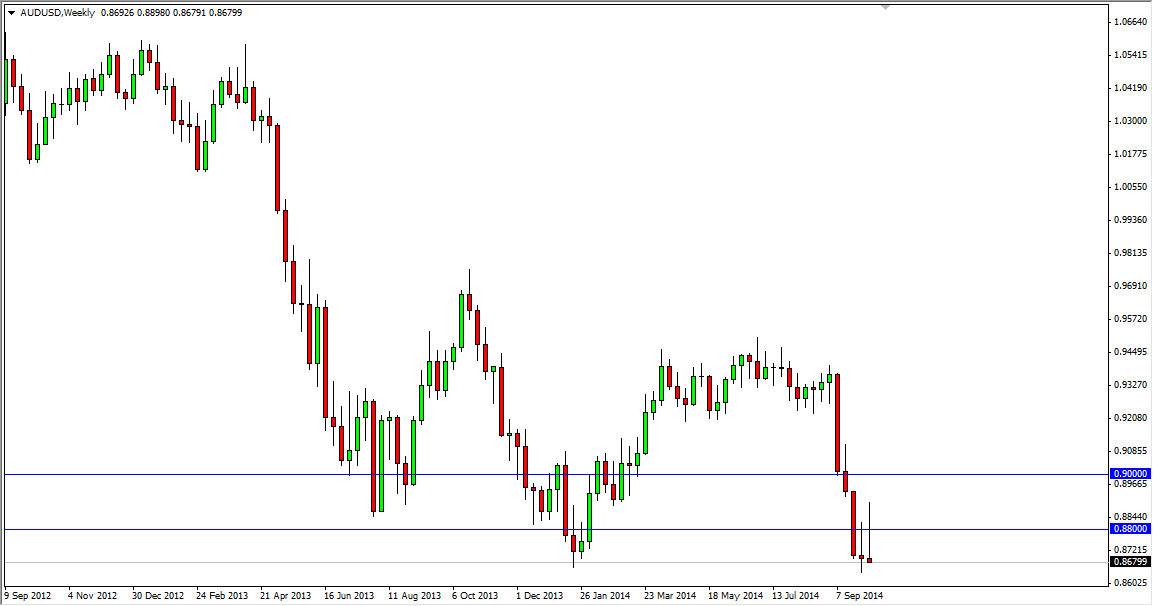

AUD/USD

The AUD/USD pair initially tried to rally during the course of the week, but as you can see found quite a bit of resistance near the 0.89 handle. The resulting action sent this market much lower, forming a massive shooting star, which of course is a very negative sign. With that, I believe that this market is ready to continue pushing much lower, perhaps as low as 0.85 in the short-term, and then ultimately the 0.80 level given enough time. This market should continue to be very happy.

EUR/USD

The EUR/USD pair initially tried to rally during the course of the week, but found the 1.28 level be far too resistive. The end result of course was a big massive shooting star, which sits right above the 1.25 handle. A break down below there sends this market looking for 1.20 given enough time, and we do believe that will happen eventually. In the meantime, you have to suspect that rallies are simply going to be selling opportunities going forward as the US dollar is without a doubt the strongest currency right now to be had in the Forex markets.

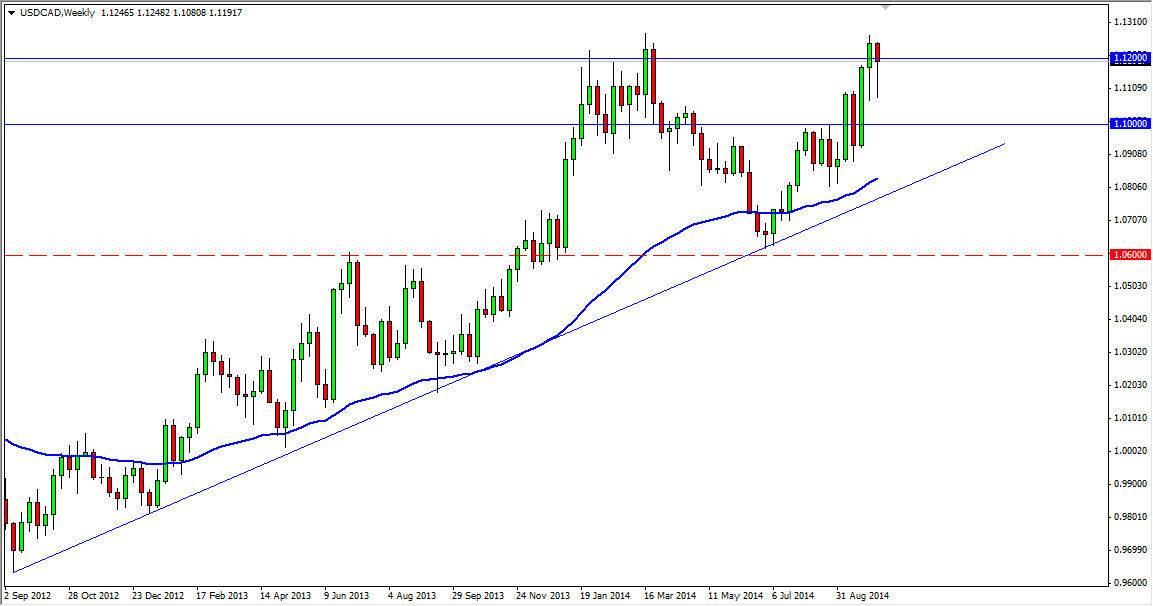

USD/CAD

The USD/CAD pair initially tried to fall significantly during the week, but found support near the 1.11 handle yet again in order to turn things back around and form a hammer for the second week in a row. Because of this, it does appear that the market will continue to go higher, and most certainly the oil markets are not helping the Canadian dollar at all. On the chart, you can see that there is a significant uptrend line, and that the 50 week moving average continues offer support as well. We believe that pullbacks will continue to be buying opportunities, and that this market will hit the 1.15 level on a break out.