EUR/GBP

The EUR/GBP pair rose during the course of the week, but found the 0.8050 level to be resistive yet again, falling back down to form a shooting star. The shooting star of course is a very negative sign, bonds there is also support somewhere near the 0.7750 region as well, so although I feel that this market is going to fall from here, I don’t anticipate any type of meltdown. That being said, it does suddenly look like the British pound might be the currency that everybody is starting to find value in.

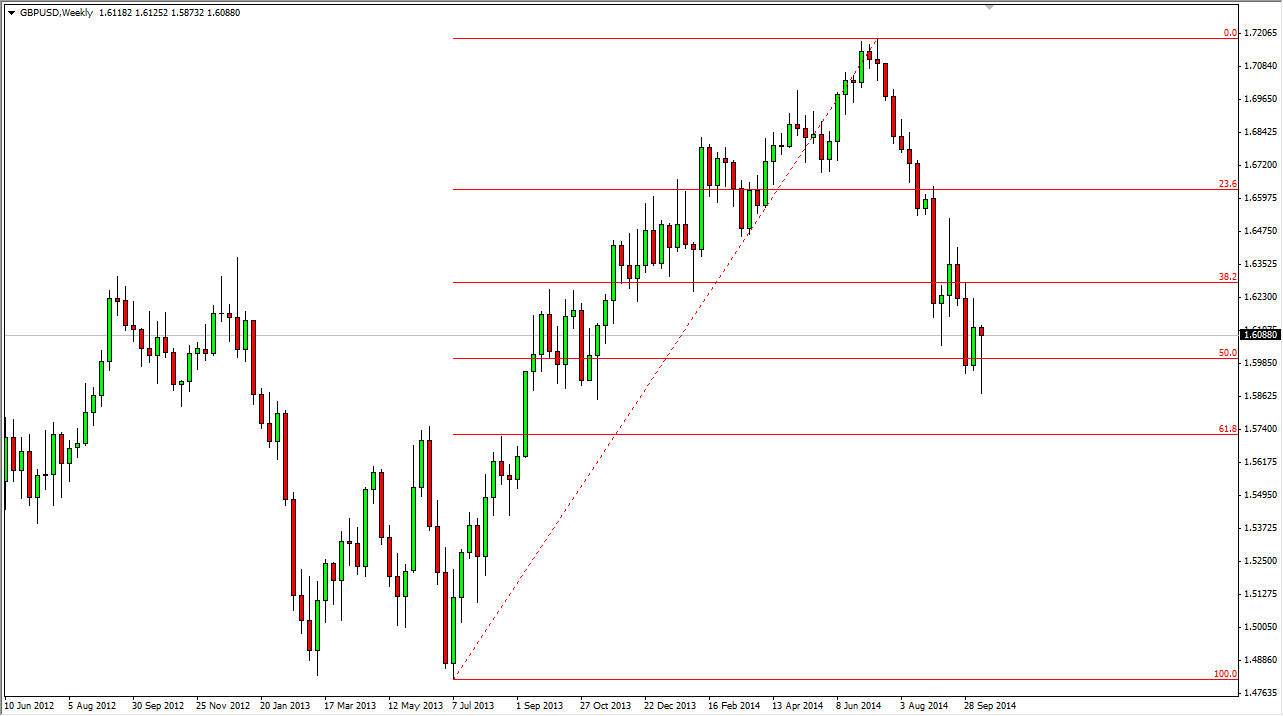

GBP/USD

The cable pair fell rather significantly during most of the week, but what’s most important is that we bounced enough to form a nice-looking hammer that is essentially focused on the 50% Fibonacci retracement level. Because of that, I feel that the markets are starting recognize that perhaps the British pound has been oversold, and if there’s any place that we are going to see a lot of buying pressure, I would anticipate it being here. On a break above 1.61, I feel that this market breaks out much higher for a longer-term run to the 1.72 handle.

EUR/USD

The EUR/USD pair broke higher during the course of the week, but if you have been listening to any of my analyses, you know that I believe the market has a significant amount resistance between the 1.28 handle, and the 1.30 handle above there. Because of that, it’s very likely that until we get above the 1.30 level, the sellers will continue to punish the Euro over and over. The fact that we pullback and formed a shooting star only strengthens the case for that resistance, and as a result I believe we are heading to the 1.25 level again. If we can get below there, we are going down to roughly 1.21 or so.

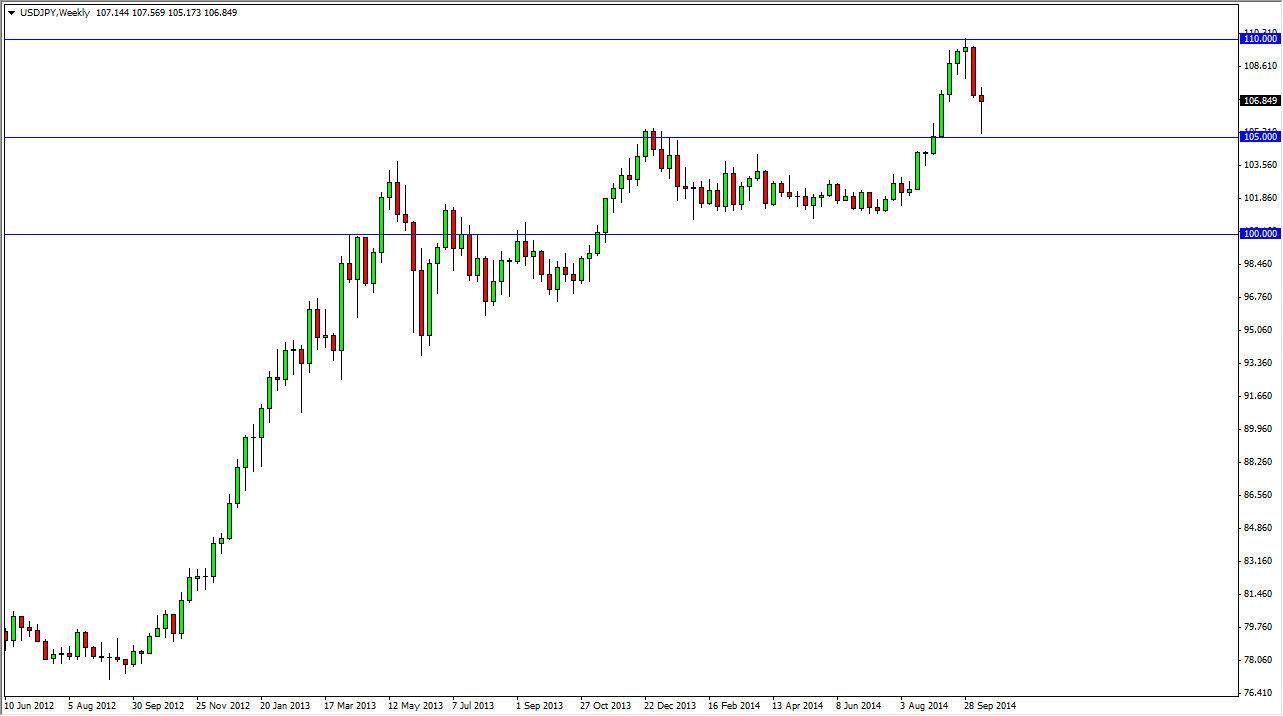

USD/JPY

The USD/JPY pair initially fell during the course of the week, but found enough support at the 105 level to turn back around and form a hammer. This hammer of course is at the perfect spot as far as I can see, so therefore I think that a break of the top of the hammer sends this market looking for the 110 level yet again, and ultimately higher levels than that. I have no interest in selling this pair.