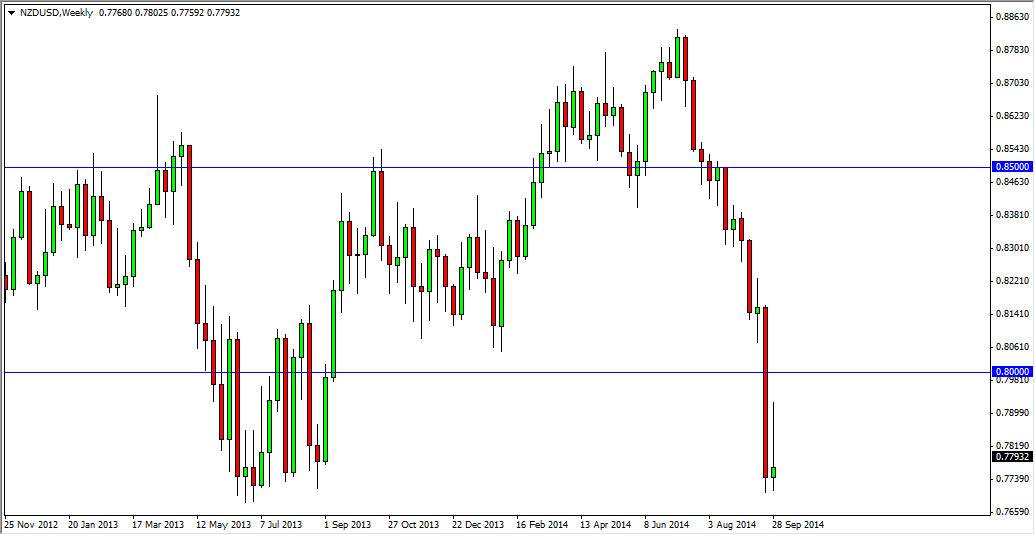

NZD/USD

This pair looks horrible. The shooting star being formed at the very bottom of a downtrend is always an interesting signal to me, as it shows that there is still serious pressure to the downside. I think this pair will more than likely breakdown from here, but a bounce is likely in the beginning of the week. The bounce should end up being a selling opportunity though as the RBNZ has been selling the Kiwi Dollar.

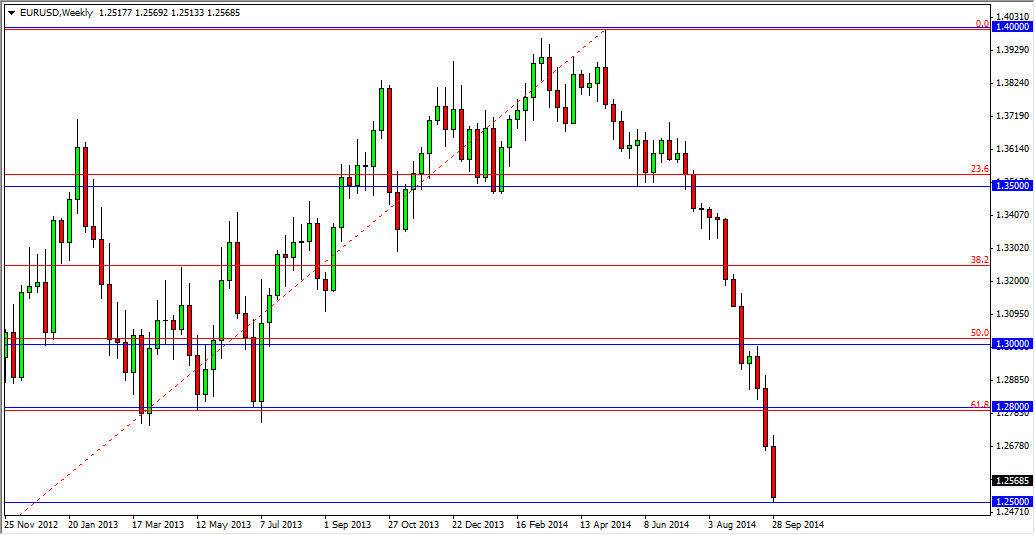

EUR/USD

The EUR/USD pair fell hard again this past week. However, the 1.25 level held as support – albeit barely. The reality is that this market is oversold, and I think that a bounce is very likely. I am not willing to buy that bounce, only fade rallies as they come. I think that the market won’t be able to get above the 1.28 level, and wouldn’t be surprised if we didn’t even make it that high.

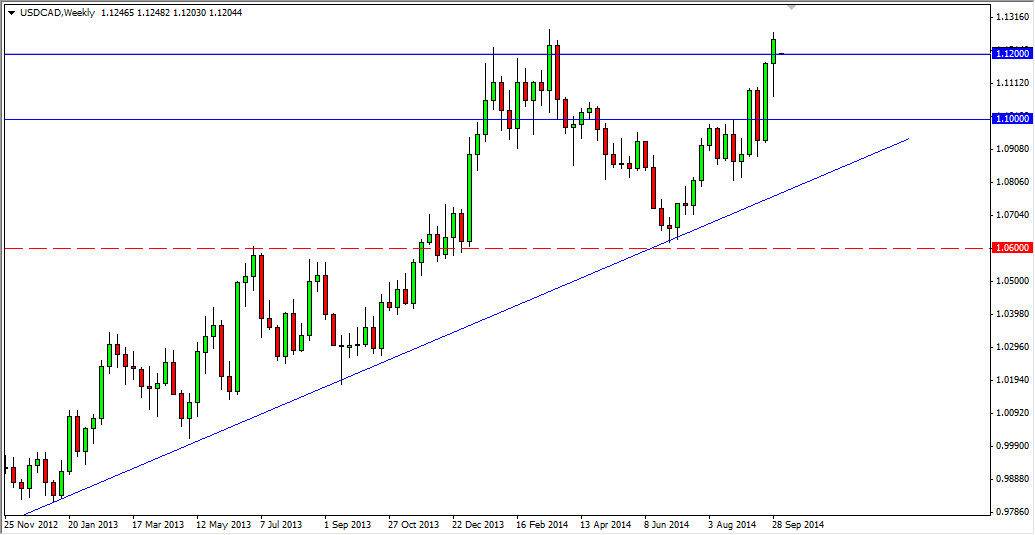

USD/CAD

This pair almost broke out for a longer-term move during last week, and as a result I think we will see a bit of a pullback, followed by a move higher and above the 1.1250 level. Once we get that, I think this pair goes to the 1.15 level given enough time. The markets certainly favor the US Dollar at the moment, and the better than anticipate jobs number certainly won’t hurt this pair either, as the oil markets haven’t exactly been supportive of the CAD.

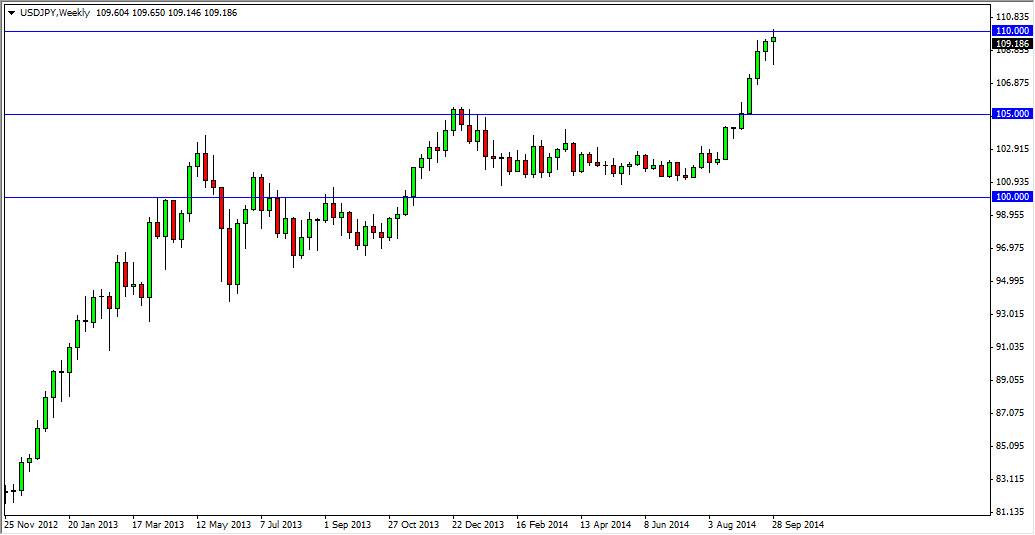

USD/JPY

The USD/JPY pair fell initially during the previous week, but found buyers below in order to turn the market around and form a nice looking hammer. The candle could be a sign that the buyers will continue to step in, which is what I believe. At this point in time, I have to think that any pullback is going to be thought of as value in the US Dollar, and will attract buyers again and again. In fact, I think that the 105 level below is the absolute “floor” in this pair at the moment, although I would be very surprised to see that number print again.