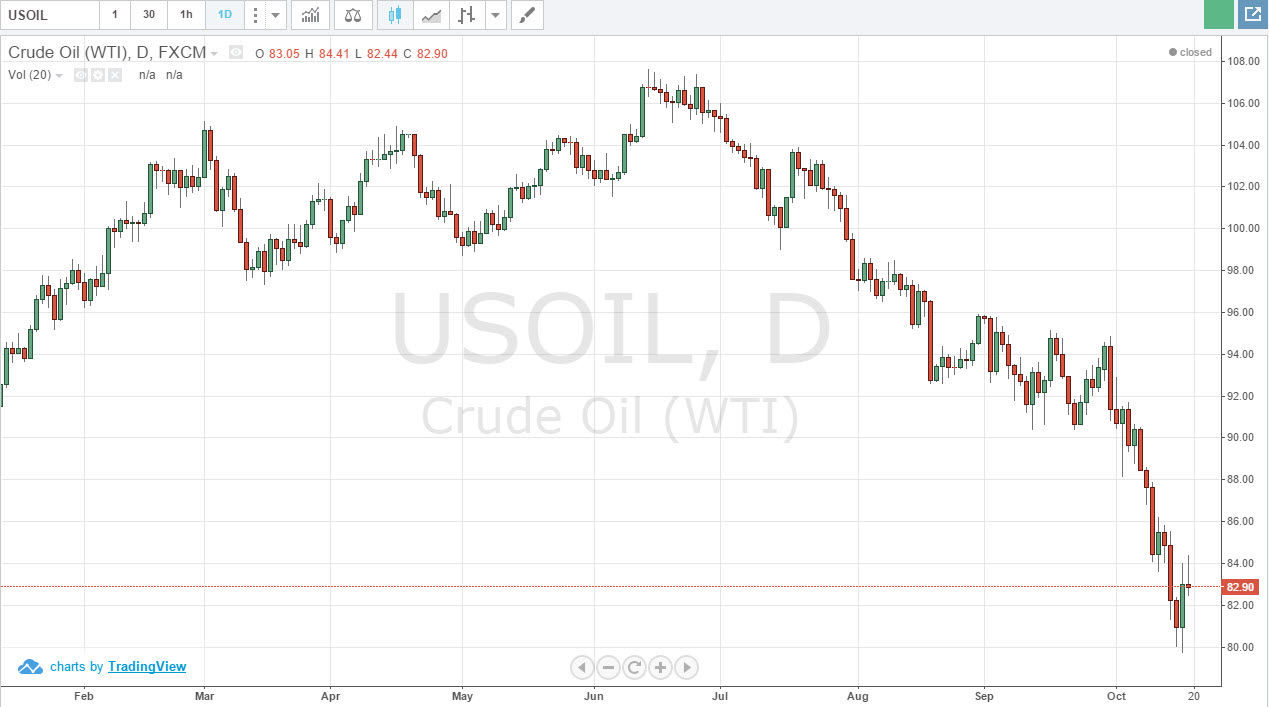

The WTI Crude Oil markets have been ruthlessly sold off over the last couple of months. That in itself isn’t anything new or newsworthy, but the fact that the bounce could produce anything close to an extended gain shows just how much trouble there is in the oil market. After all, the Friday session produced a shooting star, one of the most bearish candlesticks you can form at the $84 handle, an area that was previously support. In other words, technically this looks like a classic “retest and then sell again” type of signal. Support simply has become resistance, as one would anticipate.

I do think that the $80 level below is of course significant, after all it is a large, round, psychologically significant number that has proven itself to be both resistive and supportive in the past. With that being the case, I think that’s where we are heading next. The question then becomes whether or not we can break down below $80, and how much effort will it take?

One-way trade

I see no way whatsoever to buy this contract so it’s essentially a “one-way trade” as far as I can see. With that, it depends on what your account size is, but if you have the ability to trade the futures markets there could be quite a bit of money to be made here. On the other hand, if you only have a smaller account, do not hesitate to use the CFD or the binary options markets as I believe that every time this market rallies it will selloff in the near future. It really is and until we get above the $90 level that I would have any concern about strength. At that point time, we still have a massive cluster of noise all the way to the $95 level, so unless we get some type of longer-term buy signal that I can’t resist, I really don’t see me going long of this market anytime soon. It doesn’t mean that I will be short of the market all the time, it’s just that I will either be short, or on the sidelines.