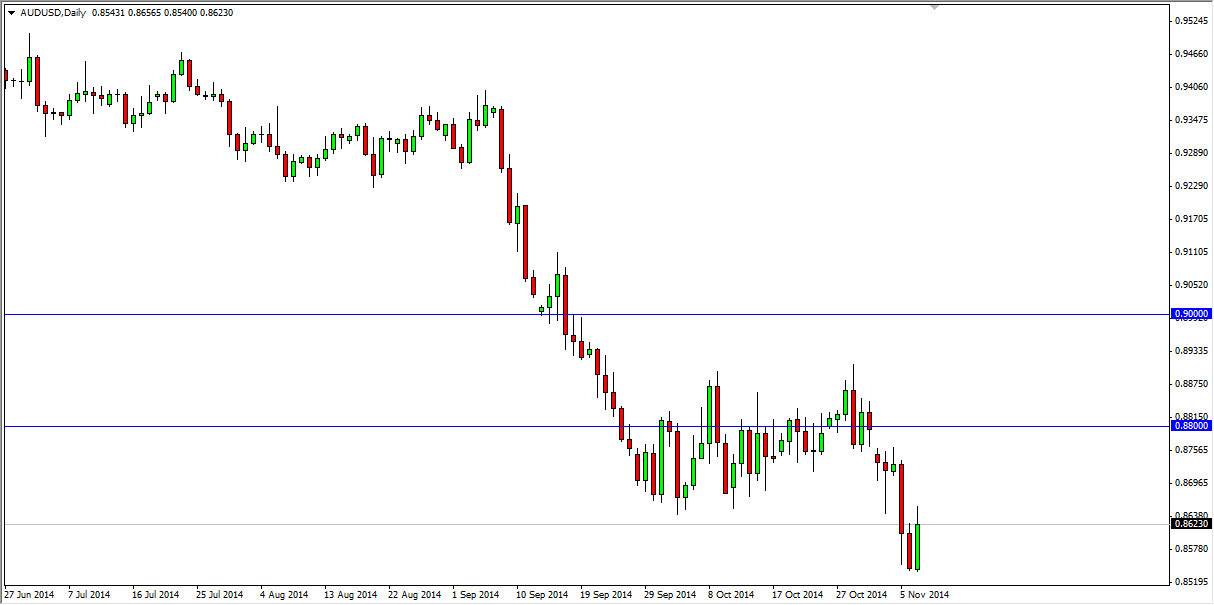

The AUD/USD pair had a positive session on Friday, bouncing just above the 0.85 handle. Because of that, it appears that the market should find sellers above, and it’s only a matter of time before we should see a resistant candle in order to take that trade. I have no interest in buying this market, as I believe that there will be a significant amount of resistance all the way to the 0.90 handle, and possibly even higher than that. On top of that, you have the problems in the gold markets which of course are not going to do with the Australian dollar any favors. After all, the currency is highly sensitive to what happens with that particular precious metal.

Ultimately, I think this market will break through the 0.85 handle, and possibly head as low as the 0.80 level. I remember years ago that it was a huge deal to break out above that level as it was a resistance barrier from 16 years previously. The fact that the area was such a massive milestone to break above tells me that it should be massively supportive as well. With that being said, I am selling rallies as they appear.

Continued bearishness

I think that we should see continued bearishness going forward as this market should continue to favor the US dollar. After all, the US Dollar Index looks extraordinarily strong, and still has a significant way to go before it hits my target of 90. That should continue to put pressure on anything against the US dollar, including both the Australian dollar and the gold futures market. In other words, there’s no catalyst whatsoever I see coming up to push the value of this market much higher. I look at any rally as “value” in the US dollar. I will continue to sell this market over and over, using short-term charts to enter as I believe that although it should be rather negative, it’s probably going to be somewhat volatile all the way down to that target of 0.80.