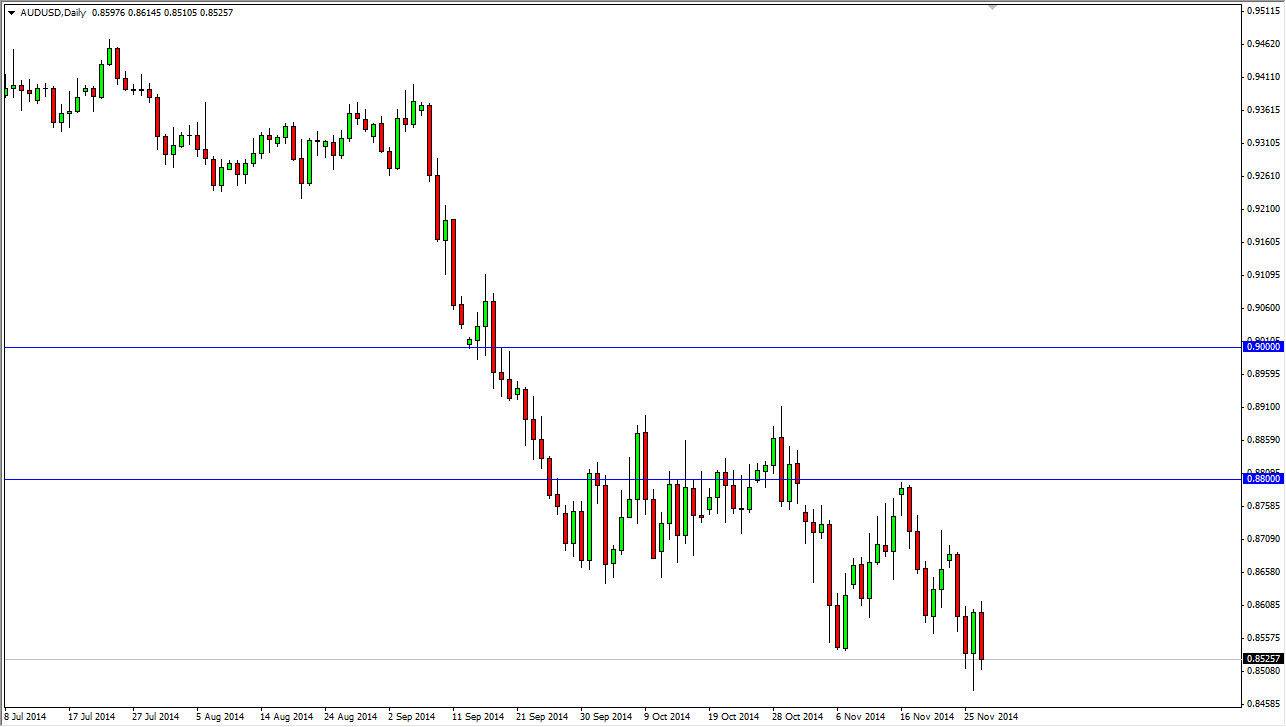

The AUD/USD pair fell during the session on Thursday, as the Americans were away for the Thanksgiving holiday. Nonetheless, this is in line with the overall downtrend anyway, so I don’t really look at this as being overly remarkable. I think if we can break down below the hammer from the Wednesday session that is a sign that we are going to continue the downward spiral, perhaps heading as well as the 0.80 level, which is my longer-term target to begin with.

Looking over at the gold markets, I don’t see anything that suggests that we are going to see significant strength, so therefore that will probably weigh upon the Aussie dollar as well. Ultimately, I think that the Aussie dollar and the gold markets both are going to fall, mainly because of US dollar strength in general. Also, let us not forget that the Reserve Bank of Australia has recently police concerns about the Chinese property market, which of course is applies a lot of the raw materials for. Less demand for raw materials out of Australia will almost certainly hurt the economy, as the mining sector is a massive part of Australia’s wealth.

Continued downtrend for the longer-term

Looking at the longer-term charts, I think that we will continue the downtrend, and I believe that the 0.80 level is a massive point on the chart that we will have to retest. A few years ago, I remember specifically breaking through this area as it was a 16 year high, and it should now be massive support. At that point in time, I would be more than willing to think about buying the Australian dollar for a longer-term move. However, we will have to wait and see what happens down there as the financial issues around the world certainly have been much worse than anticipated. Six years ago, it looked as if the world was falling apart. However, after that a lot of people suggested that perhaps it wasn’t as bad as we thought. Here in 2014, we recognize that perhaps the damage really was that bad. With that, we have plenty of erratic behavior in the financial markets, and I believe that there is still a bit of negativity out there.