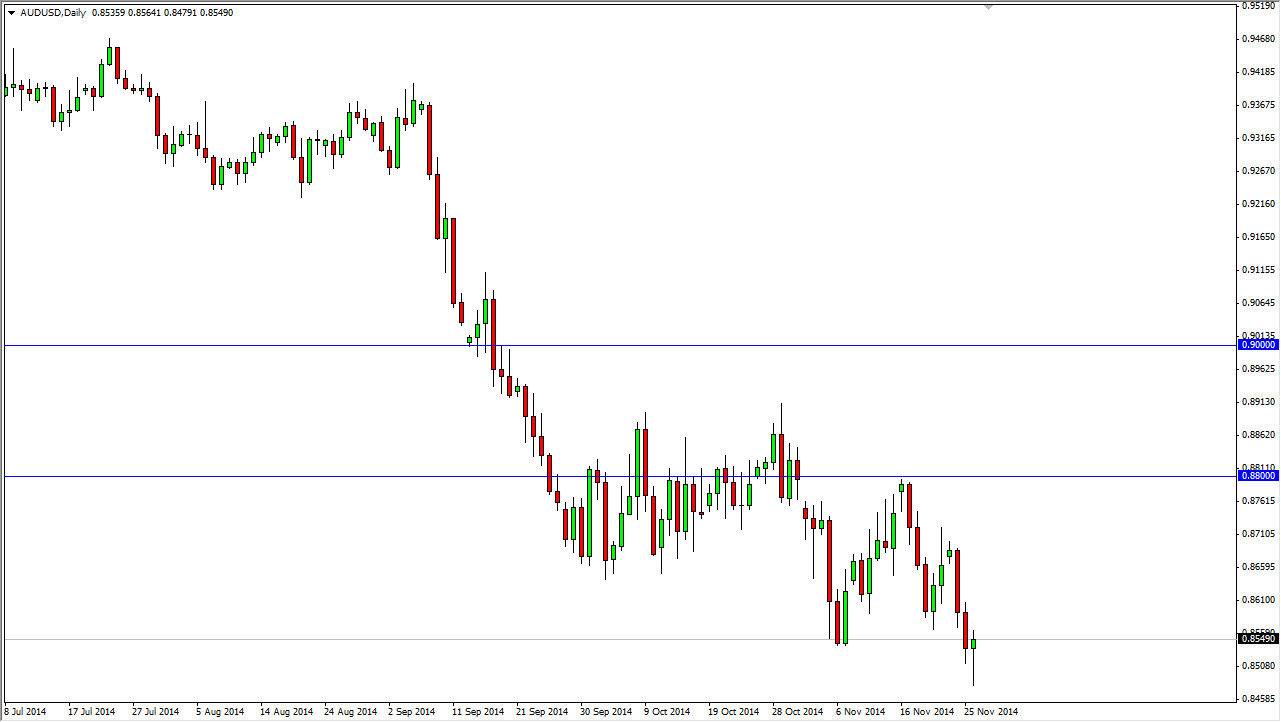

The AUD/USD pair initially fell during the course of the day on Wednesday, breaking down below the 0.85 level at one point in time. There was plenty of support below, so we ended up turning the market around to form a hammer, which of course is a very surprising and supportive candle. That being the case, the market more than likely will find buyers if we break above the top of the hammer and go back into the previous consolidation area. However, I am not interested in buying this market as I think it will simply be a decent opportunity to pick up value in the US dollar. After all, there is a reason that the Australian dollar has fallen over the longer term.

That being the case, I believe that the gold markets will continue to fall given enough time, and that of course works against the value the Australian dollar in general. It also tends to boost the value of the US dollar the same time, so this makes it a little bit of a “perfect storm” when it comes to treating the AUD/USD pair.

RBA suggests Chinese problems

The Reserve Bank of Australia has suggested recently that it is concerned about the Chinese property markets, and that of course has a significant amount of influence on the Australian economy as well. After all, the Australians are major supplier of commodities for Chinese construction as well as the Chinese economy on the whole. With that, I feel that this market will more than likely find sellers every time it rallies, and as a result I am simply going to wait to see significant bearish pressure on short-term rallies in order to continue to pick up US dollars. I believe that the Australian dollar will continue to be beat down, especially considering the commodities themselves are in a significant amount of trouble. Because of that, the pair should continue to be a nice selling opportunity. However, if we break down below the hammer, we believe that is the “trapdoor” opening in order for the Australian dollar to fall significantly.