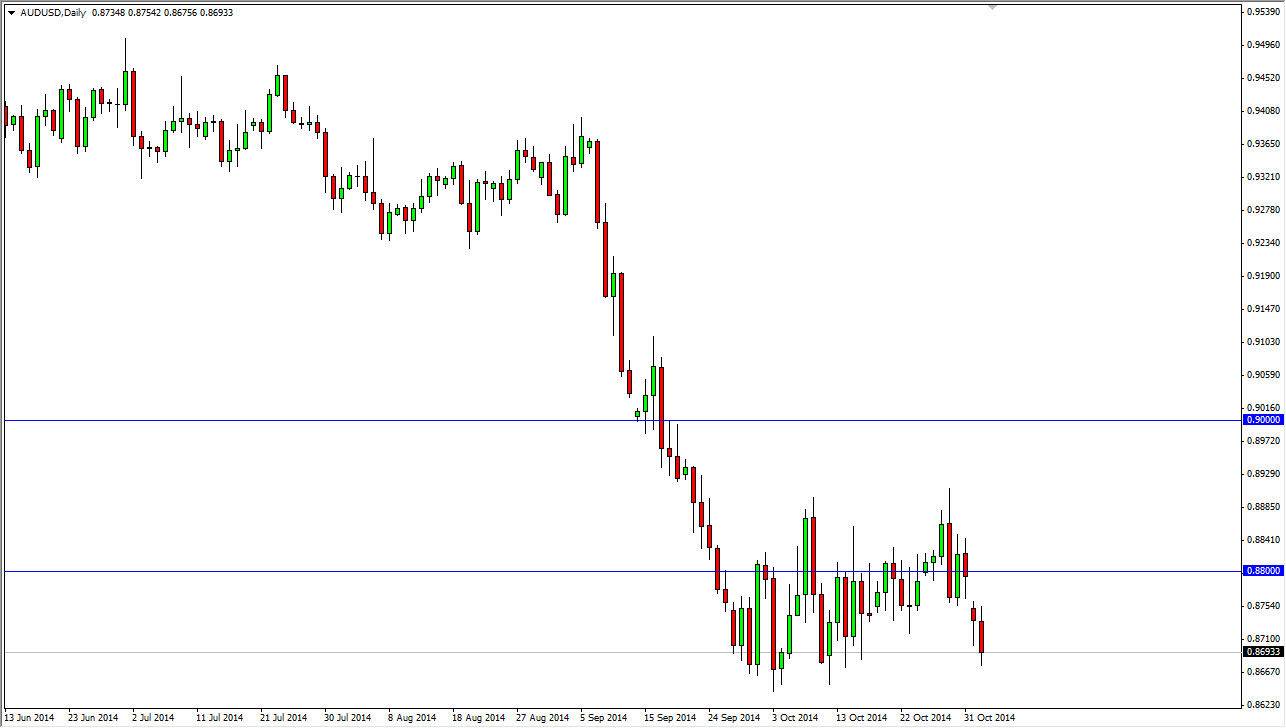

Looking at the AUD/USD pair, you can see that we gapped lower at the open for the week, and then continue to go much lower. We have not broken down below the recent lows, but it does appear that we are going to attempt to do just that. Will we bounce from here first before finally breaking down? I don’t know the answer to that but I do recognize that there is no way whatsoever to be long of the Australian dollar at this point in time.

I recognize that the next “round number” is the 0.85 handle. I don’t see any reason why this market won’t go down to that level, and it’s probably only a matter of time before we go even lower than that. Gold markets certainly are not doing the Australian dollar any favors recently, and because I think that it’s only a matter of time before the two just simply crumble.

Selling rallies will continue to be my strategy

Looking at this chart, if we do bounce from here, I will simply look for some type of resistant candle on the shorter-term charts in order to continue selling the Australian dollar. I would be especially interested near the 0.88 handle, as it is an area that has certainly brought out the sellers recently. I also recognize that a break below the 0.8650 level would more than likely have this market heading down to the 0.85 handle rather quickly, and as a result I would be a seller of that particular move as well.

I see resistance all the way up to the 0.9050 handle, which of course is a long way from here. On top of that, I don’t see anything in the gold markets that make me particularly excited about owning the precious metal, and we all know that the Australian dollar is heavily influenced by that particular commodity, and is quite often traded as a proxy for gold. Because of that, I simply cannot give a reason to buy this marketplace currently.