By: Stephanie Brown

The Coca-Cola Co (NYSE:KO) stock received a lift in the market after the giant beverage company confirmed it had entered into a definitive agreement with Great Lakes Coca Cola Distribution LLC. This confirmation follows an announcement made in April of last year that the company signed letters of intent with five U.S bottlers. The merger will essentially allow Coca-Cola to expand into other territories as well as create stronger U.S. business models that should impact its total sales.

Great Lakes Coca Cola Distribution, a wholly owned subsidiary of Reyes Holdings LLC already granted Coca-Cola access to the greater Chicago area. The transaction is set to close in 2015 although financial terms of the agreement have not yet been disclosed. Reyes Holdings has already been accredited for being at the forefront in building strong brands in mature markets. The company is one of the largest global distributors for food and beverages, delivering over 800 million cases annually.

Jude Reyes, Founder and Co-chairman of Reyes Holdings believes the partnership will allow both parties to leverage each other’s strengths and refresh Coca-Cola fans with iconic brands throughout Chicago. As part of the five newly signed agreements, Coca-Cola will work on improving its integrated information technology platform. The company will additionally work to develop a new beverage agreement that supports its evolving operating model.

Coca-Cola’s net revenue in the last quarter remained flat as the company continues to be immensely affected by fluctuations in currencies especially with a strengthening U.S dollar. The company, along with other soda companies continue to feel the effects of change in consumer tastes, as most of them are shifting to healthy drinks and away from sugary beverages.

Technical Analysis

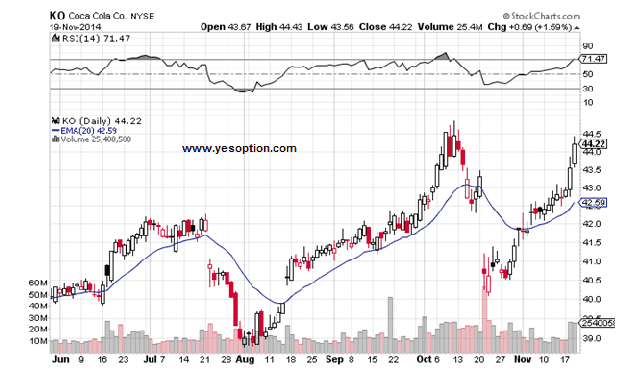

Coca-Cola’s daily chart is a perfect delight for any trader who is looking for trend and momentum. The stock has been making higher highs since the 20th of October. Going forward it looks very much like this upwards trend will continue, as long as it trades above its 20-Day EMA of $42.59. However, if any downwards trend were to commence, the stock would need to close in the negative for two consecutive days.

Actionable Insight

Buy Coca-Cola Co (NYSE:KO) above $44.5 for target of $45, $45.4, with a stop-loss of $44.2.