Gold prices ended flat on Thursday as the market took a breather ahead of key economic data from the United States. Wednesday's upbeat private employment data and yesterday's jobless claims figures raised expectations of a solid nonfarm payrolls report. Solid gains in employment would increase the likelihood of an earlier rate hike. Not very long ago, Federal Reserve officials said a stronger labor market would pave the way for tightening monetary policy.

Meanwhile, sharp declines in gold prices have unleashed a surge in demand for coins and small bars by retail investors around the world. However, we witnessed the same situation back in April 2013 when prices slumped to $1322 an ounce so whether this buying frenzy will provide a lift to gold is a mystery. The sell-off in gold could get worse as the American dollar extends gains, especially if the Fed turns more hawkish in the coming months.

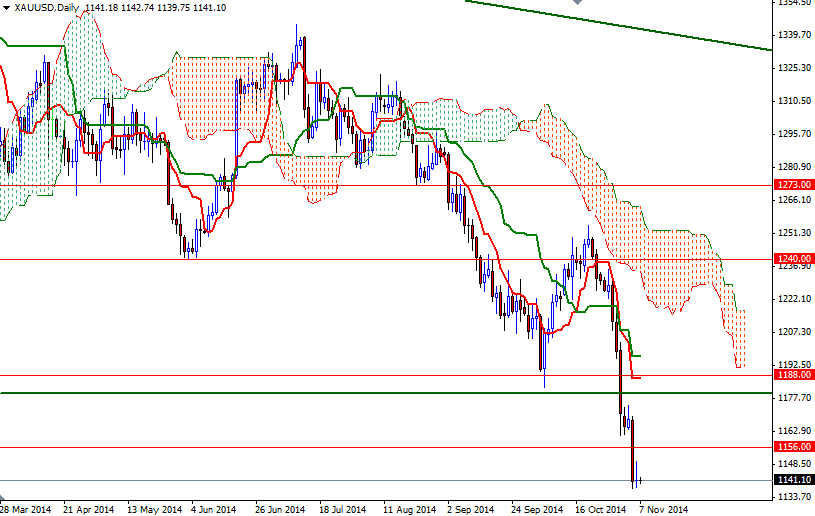

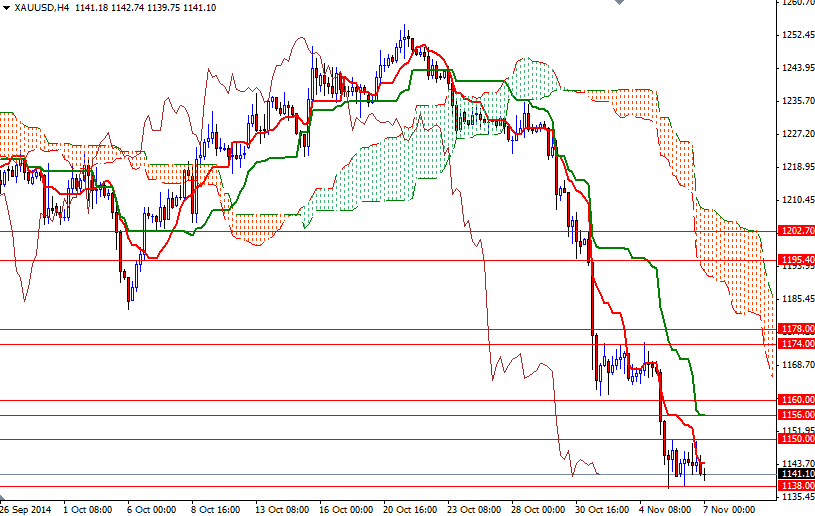

Since there are various factors that drive the price of gold, sticking to technical analysis is the smartest thing to do. From a technical point of view, the broader directional bias remains weighted to the downside while prices remain below the Ichimoku cloud on the weekly and daily time frames. The Chikou-span (closing price plotted 26 periods behind, brown line) is indicative of solid downward momentum, plus the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are negatively aligned. With these in mind, I think the key levels to watch today will be 1138 and 1150. It is quite possible that the XAU/USD pair will continue to fall, targeting the 1127 level, if the 1238 support gives way. Once below that, the bears will be aiming for 1115 and 1108/3. The bulls will need to pull the market back above the 1240 level in order to approach the bears' camp around 1156/4.