By: Stephanie Brown

High operational costs are making eBay Inc. (NASDAQ:EBAY) rethink how its same-day delivery system should operate going forward heading into the busy holiday shopping frenzy. The giant online retail store has already pulled down its eBay Now from App stores as it tries to plant its next course of action.

The company’s spokesperson already confirmed that eBay is trying to ensure that it does not operate as a standalone application but will be enjoined with eBay’s main mobile app and website. Having debuted in San Francisco in 2012, expanded into other cities notably, Manhattan. However, expansion to other cities in 2015 is now on hold.

The company acquired U.K based shuttle in October 2013, looking to bolster its same-day delivery system in the U.K instead of having to rely on its own fleet of cars. Its closure of its same-day delivery system in the U.S. is poised to come with a number of negative effects in the short-term. Some of the big retailers that rely on eBay now include, Home Depot Inc. (NYSE:HD), Walgreen Company (NYSE:WAG) and Best Buy Co Inc. (NYSE:BBY).

Although eBay Now did not completely close, but it remains to be seen how long its service will remain stale. Its long-term focus is not on the same-day delivery expansion but rather on expanding other logistics, especially when it comes to dealing with smaller merchants. The company is believed to be devising mechanisms that will allow smaller sellers with sales of $100,000 and below be in a position to allow customers pick up items bought on online stores.

Technical Analysis

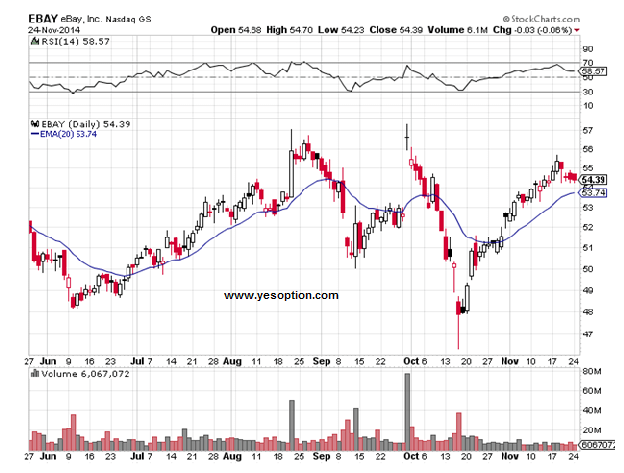

eBay has been trading sideways and in a very narrow range of $2 over the last few trading sessions. The stock is trading above its 20-Day EMA of $53.74 with its RSI indicator moving in straight line, currently standing at 58.57. Moving ahead, eBay has support at $53.50 and $52.10, and resistance at $55.5 and $58 on the upside.

Actionable Insight

Sell eBay Inc. (NASDAQ:EBAY) below $54.2 for target of $53.7 and $53 with stop-loss of $54.5