By: Stephanie Brown

Apple Inc. (NASDAQ:AAPL) hit a fresh 52-week high on Friday and is showing no sign of reversing. The stock is in the midst of an impressive rally, and is generating a fresh wave of excitement among investors and analysts as the holiday season enters. With demand for the new flagship IPhones reaching unprecedented levels, many believe that this holiday season should be a blockbuster one for the company.

The company very recently announced that its IPhone sales are not only a hit in the domestic markets but emerging markets such as India and China are increasing their demand. The only sour point in its recently released quarterly reports were its floundering iPad sales. However, its highly anticipated entry into the wearable technology can overcome this slump.

Although the company trades at premium valuations, it has been able to meet most consensus estimates, and therefore has become a stock which commands high valuations. Additionally, the stock-split has been able to attract a lot more retail investors, which provide further impetus to its stock price.

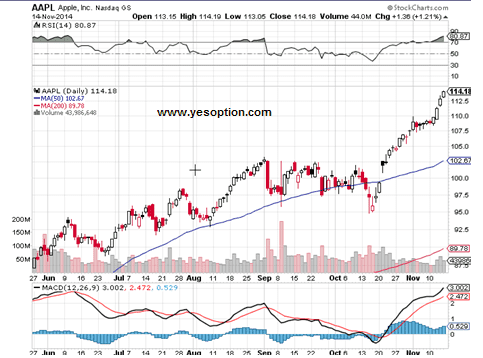

When looking at the daily chart for Apple, the stock is in a strong upwards trend, creating new highs on a daily basis. As of now the stock is trading above its daily moving average. Meanwhile its momentum indicator is trading in bullish territory and is displaying no signs of reversing, indicative of strong buying interest at current levels. Lastly, although its relative strength index is in the overbought territory it is only rising, which of course is a bullish sign.

Actionable Insight:

Long Apple Inc. (NASDAQ:AAPL) at current levels for a short term target at $120, with a stop loss below $111.