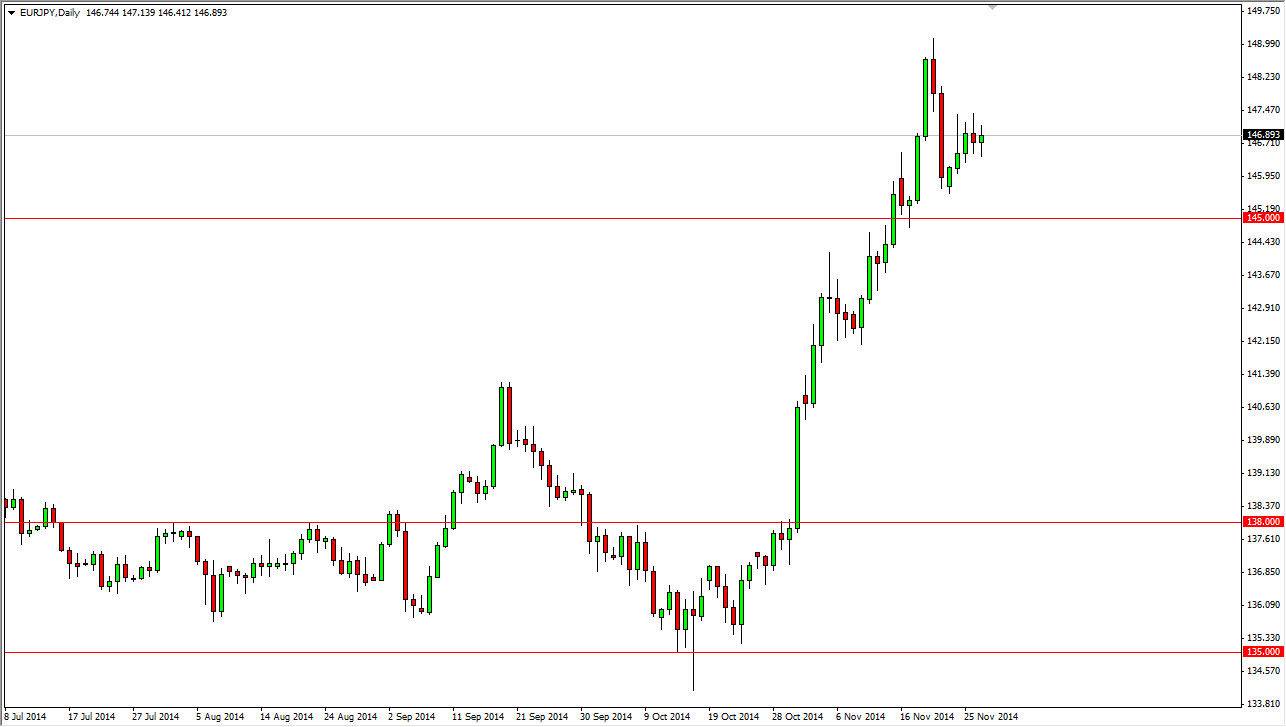

The EUR/JPY pair did very little during the Thursday session as the Americans were away at holiday, and the rest the world simply did not move the ball very far. However, this is a pair that certainly has a significant amount of bullish pressure underneath it so I look at it is a market that can only be bought. I think that the 145 level below is massively supportive, and as a result I think that any dip to that area will more than likely attract buyers again. I should also take a moment to explain that I believe that the support at the 145 level also extends all the way down to the 144 level. It’s essentially a zone.

I don’t like the Euro. Most of you know this, but at the end of the day I believe that the Japanese yen is hated even more. Because of this, the market will continue to go higher given enough time, and it’s only a matter time before we test the 150 level in my opinion. In fact, I would not be surprise at all to see that happen sometime during the month of December, although I am the first person to admit that I do not trust the lack of liquidity towards the end of that particular month.

Long-term trend

I believe that this is a longer-term trend anyways, and as a result I am willing to buy dips as they appear. There is no way to short this market, because then essentially means that you are buying the Japanese yen, a currency that has its own central bank feverishly working against its own value. Because of this, I believe that the currency markets will continue to punish the Yen overall, which actually is the normal way of things.

Ultimately, I believe that you can buy and hold this currency pair if you use low leverage as I believe that we are in a multitier uptrend. This reminds revealed carry trade days, when you to simply bought yen related pairs every time they fell.