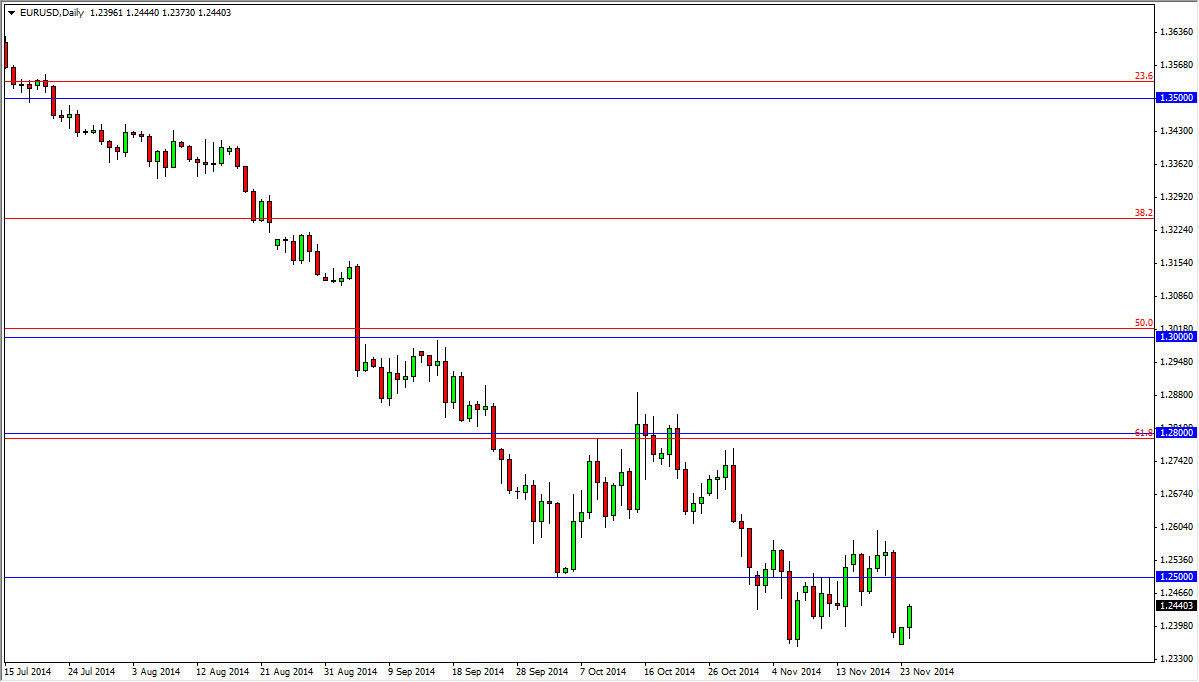

The EUR/USD pair initially fell during the course of the day on Monday, but ended up finding enough of buying pressure underneath to turn things back around and form a slightly positive candle. However, I don’t see any way to buy this pair for any great length of time, because the 1.26 level above has been so resistive. Ultimately, I expect to see resistive candle that turn things back around and offers a nice selling opportunity. At this point time, we obviously don’t have it but this could be a fairly quiet week due to the fact that it is Thanksgiving in the United States, meaning that Americans won’t be as involved.

I will be waiting for this pair to show the right resistive candle in order to start selling, and I feel that it’s only a matter of time. I still believe that this market goes down to the 1.2050 level given enough time, so I have no interest in buying. In fact, I find it almost impossible to buy this pair until we break above the massive resistance barrier between the 1.28 level, and the 1.30 level. I really think that is where the trend changes.

Follow the trend, that’s where the money is

All you do in a market like this is follow the trend. There’s obviously many ways to make money in Forex, but when trading with a trend that is strong, it’s much easier. Quite frankly, the Federal Reserve has stepped out of the quantitative easing game so that of course makes the US dollar strong against most currencies. On the other side of that equation though is the fact that the European Central Bank of course is going to have to keep its monetary policy loose at the least, and could possibly even have to get more creative about loosening its monetary policy. I see no reason to buy this pair, and every time it rallies I look at it as value in the US dollar. With that, I am a seller.