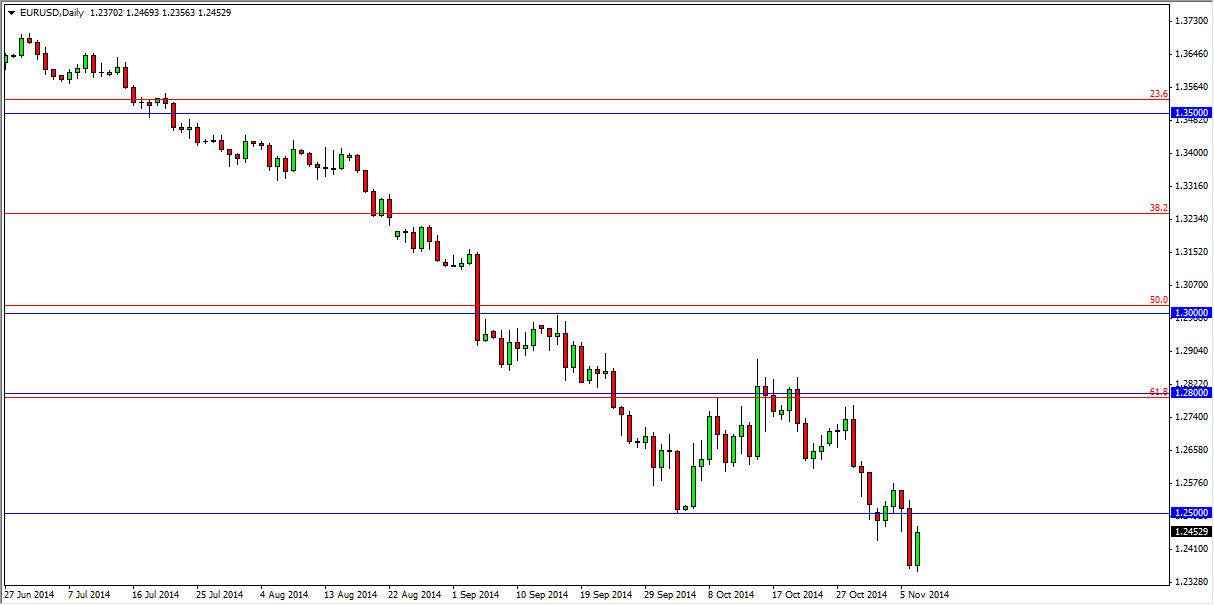

The EUR/USD pair bounced during the session on Friday, reaching towards the 1.25 handle. This of course suggests that we could get selling pressure soon, and as a result I am looking for a resistant candle in order to take advantage of the longer-term downtrend. With that, the market is more than likely going to head towards the beginning of the uptrend that we had initially seen at the 1.2050 handle. Ultimately, it’s likely that we could find plenty of selling pressure above that 1.25 level as well, so really at this point time I have no interest whatsoever in buying this market.

On top of that, the market appears that it is more than likely going to continue to be a “sell on the rallies” type of situation, especially considering that the European Central Bank is almost undoubtedly going to have to loosen its monetary policy. At the same time, the Federal Reserve continues to step away from quantitative easing, and that means that we should continue to have bullish pressure in the US dollar.

Longer-term trend?

I don’t know if we can go lower than that, but right now I’m not willing to go against this longer-term trend to the downside. I believe that ultimately we should see more and more downward pressure and an acceleration in the move, just simply because I think the 1.25 level has such a large psychological significance. Ultimately, I believe that a lot of short-term players will continue to pushes market lower as bounces will, almost every other day.

Looking above, it is not until we get above the 1.30 level that I would be comfortable buying this market. With that being the case, I’m not even paying attention to potential long setups, as is market certainly is falling for a particular reason. I also believe that there will be a significant battle near the 1.20 handle, and at that point time we could possibly see a longer-term set up to the upside, but we are a long way from there.