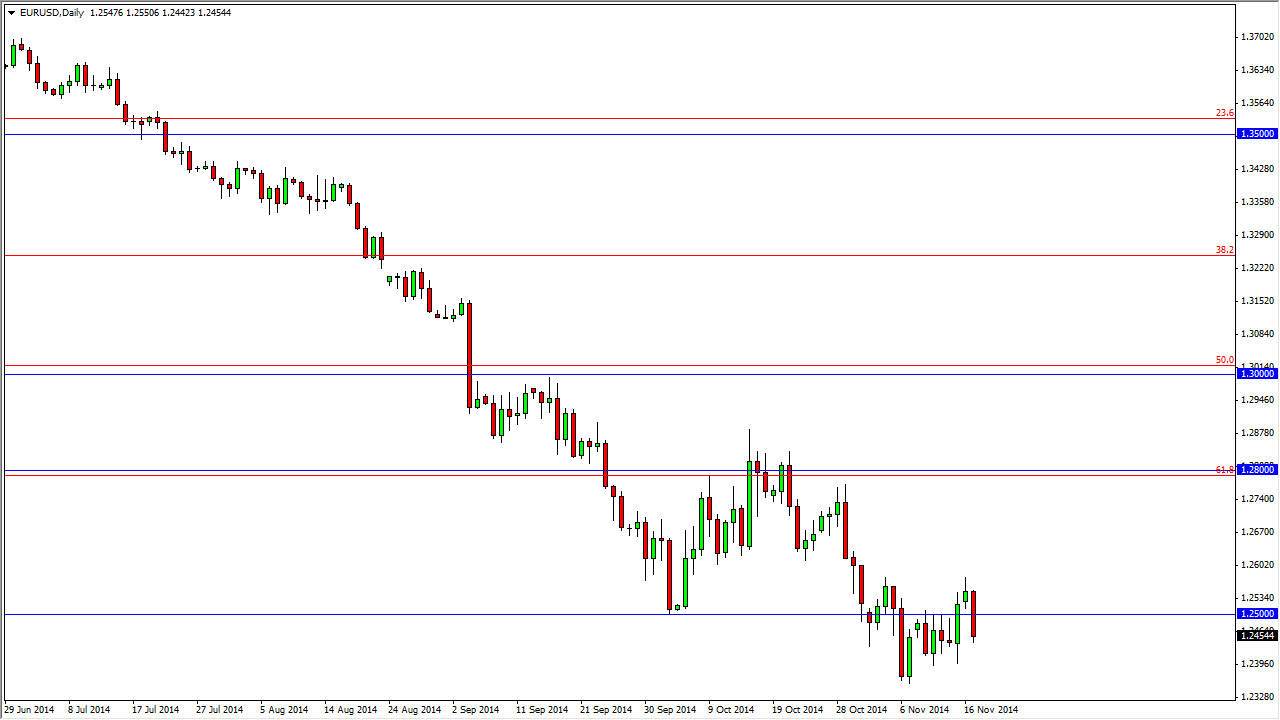

The EUR/USD pair tried to rally initially during the session on Monday as I had suggested on Friday would. However, the 1.26 level offered resistance, and it appears now that we are ready to break down from here. Ultimately, I think we still go down to the 1.2050 level, but there’s probably going to be a few areas of support between here and there. The 1.25 level was sliced through relatively easy during the session, and that makes sense as we have crossed it a couple times now. That means that is becoming less and less important, and with that it’s only a matter of time for 1.25 is nothing but a distant memory.

I believe that any rally at this point in time is probably going to be a nice selling opportunity as the market is most certainly bearish overall. You have to keep in mind that the central banks are on two totally different paths, with the Federal Reserve tightening and the European Central Bank looking to loosen its monetary policy sometime in the near future, meaning that this pair should continue to go much lower.

Continue to sell rallies

I think that this is a market that you can continue to sell every time it rallies, as the marketplace should eventually reach much lower levels. I think that short-term traders will continue to short this market again and again, as it is the “gift that keeps on giving.” I believe that the writing is on the wall, as the Euro looks horrible against just about every other currency out there as well. Contrast that with the fact that the US dollar is the strongest currency in the Forex markets at the moment, it makes perfect sense that we should continue to see fairly soft action in this pair, and that the market simply cannot be bought. In fact, I think that it is not until we break above the 1.30 level that I would be comfortable doing so, and that of course is something that is unlikely to happen anytime soon.