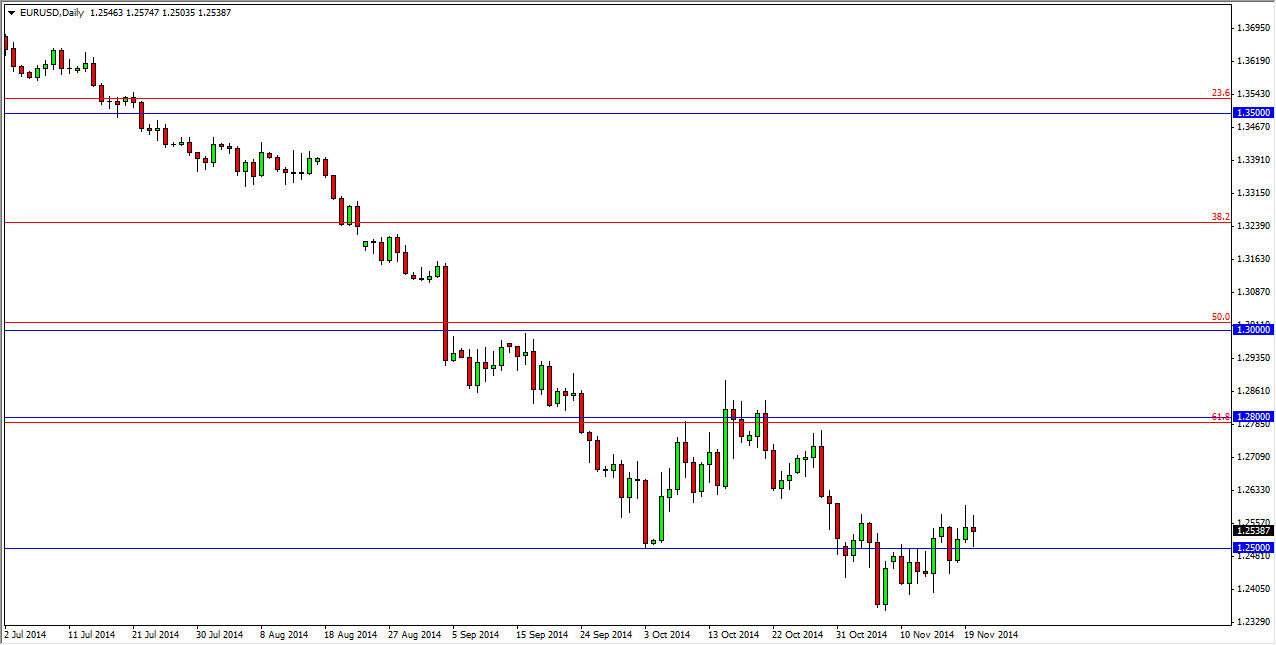

The EUR/USD pair continues to grind sideways and just above the 1.25 handle. The session on Thursday showed more sideways action, and I believe that we are trying to build up enough downward momentum to take advantage of the strength in the US dollar and push this pair much lower. Ultimately, it’s only a matter of time before we break down as far as I can see, and I would be very suspicious of any rally that doesn’t clear all the way to the 1.30 level, something that would take an inordinate amount of strength. In other words, at that point time I think that the trend changes, but I don’t see it happening anytime soon, and quite frankly a move below the 1.25 level is enough for me to start selling.

I believe that ultimately this pair goes down to the 1.2050 level as you all know, and with that I think we have a long way to go. This will probably take quite a bit of time though, because there is so much noise between here and there. However, keep in mind that the European Central Bank is going to have to loosen its monetary policy soon, while the Federal Reserve is losing its quantitative easing program altogether.

Selling rallies

I continue to sell rallies going forward as I believe this market will continue to chop and fall. Ultimately, this market looks as if it could go much lower but I think there are always going to be reasons to buy the Euro for some people. This pair has a really hard time selling off the Euro for long periods of time in sudden burst, so it really take something special have that happen. With that being the case, I will continue to stick to the short-term charts as that seems to be the best way to trade this marketplace when it starts acting like this. Ultimately, I have no interest in buying whatsoever, so I will continue to short again and again and again.