The EUR/USD pair rallied during the session on Wednesday, breaking back above the 1.25 level during the day. However, I believe that there is a massive amount of resistance at the 1.26 level. This is an area that has caused resistance in the past, so quite frankly I believe that’s what’s going to happen again. Today is Thanksgiving in the United States though, so expect almost no liquidity in the marketplace once the Europeans go home for the day. With that being the case, we could very easily have fairly erratic movement during the session, and with that being the case it’s a market that could be a bit dangerous for the session.

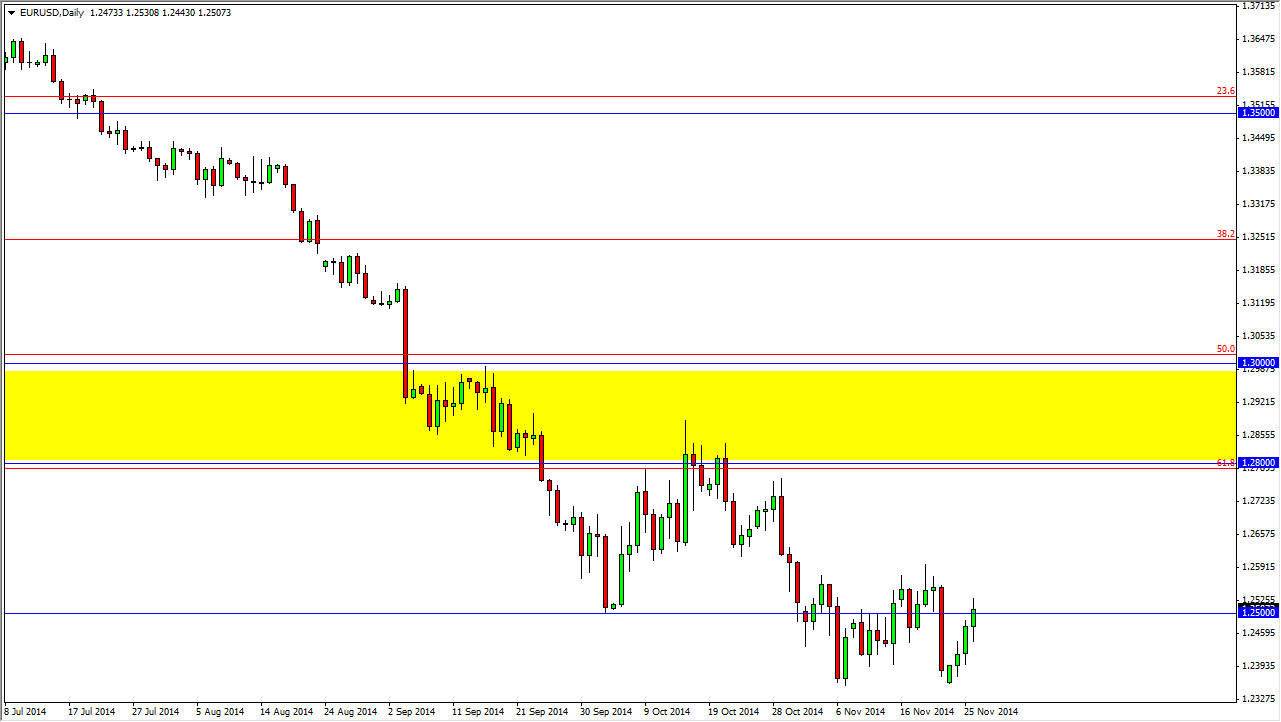

As you look on the chart, the yellow box shows how significant resistance is above the 1.28 level, and with that being the case the market should be very difficult to overcome all the way to the 1.30 handle. With that being the case, if we break out to the upside we could see quite a bit of resistance and therefore is going to be almost impossible to hang onto any long position anyway. With that being the case, I think that it will simply dictate value in the US dollar, and the sellers will come in and a fist.

European Central Bank

The European Central Bank will more than likely have to loosen the monetary policy that they have in order to keep the European economy somewhat afloat while the Federal Reserve is stepping away from the quantitative easing game altogether. That being the case, the market looks as if it is offered a bit of value when it comes to the US dollar, and as a result I am simply waiting for the right signal. I am looking to aim for the 1.2050 level over the longer term, but the immediate target is probably closer to the 1.24 level which is the most recent area that the market bounce from. Ultimately, this market should continue to offer plenty of selling opportunities.