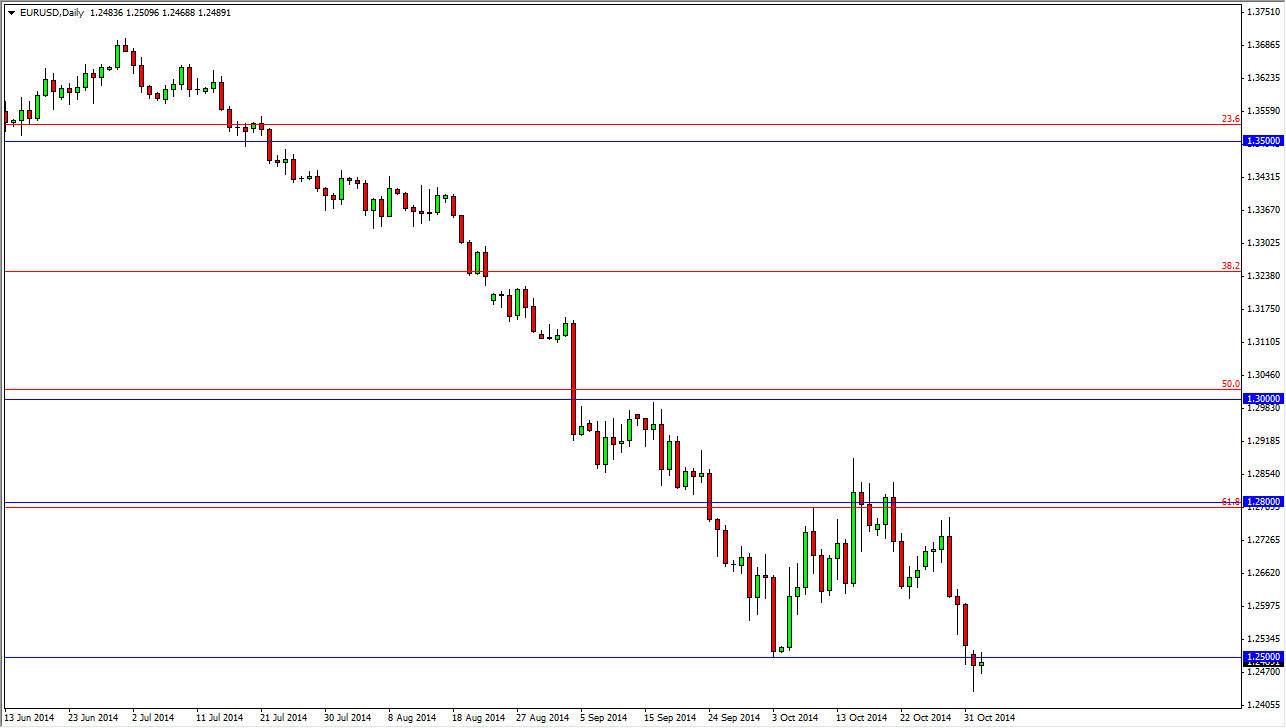

The EUR/USD pair continues to test the 1.25 level, an area that of course is a big round number. That of course should bring in a lot of interest, as a lot of the large order flow tends to hang about these types of levels. With that in mind, it is not a big surprise to me that this market failed to break down significantly. However, I still believe that the market will eventually break down below the 1.25 level, and go to much lower levels, most specifically the 1.2050 handle given enough time.

I think it that any bounce from this area will simply be a nice selling opportunity, and that extends all the way to the 1.28 level. That area begins a massive amount of resistance that extends all the way to the 1.30 level, so it would take something truly special for this market to be able to break out above that massive resistance barrier. Because of this, I am “sell only” in this marketplace, not to mention what’s going on with the central banks.

Central banks will direct this pair lower

The European Central Bank should continue to loosen its monetary policy going forward, just as the Federal Reserve exits quantitative easing. Because of this, I believe that this market will continue to drop, and the market should essentially end up making a “round-trip” back to the beginning of the uptrend, the aforementioned 1.2050 level. I believe this mainly because we have broken through the 61.8% Fibonacci level at the 1.28 level, and that normally means that the market goes back to the beginning of the uptrend once that level is broken.

Don’t get me wrong, I don’t think this is going to happen overnight and I recognize that the markets will more than likely bounce from time to time. However, those bounces should be selling opportunities as far as I can see, and with that in mind I don’t see any reason whatsoever to look at this market as one that should be bothered with as far as the long side is concerned.