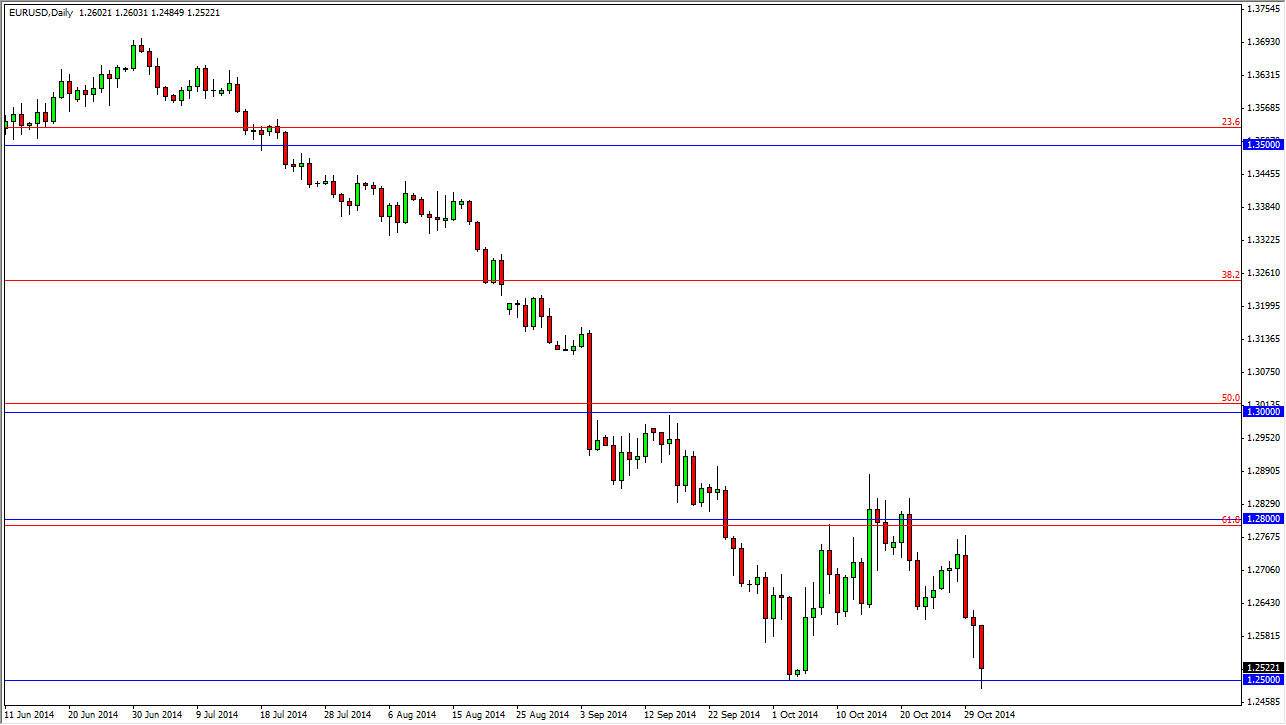

The EUR/USD pair fell during the session on Friday, as we continue to see weakness in the Euro. The US dollar is by far the most favored currency in the world right now, so it’s not a big surprise this market fell. On top of that, the European Central Bank is all but assured to continue its loose monetary policy, and probably add to it. With that being the case, the Euro should continue to fall, and although the 1.25 level is a large, round, psychologically significant number, I believe that it’s only a matter of time before we break down through that area.

Breaking down below the 1.25 level would be is significantly bearish move, probably sending this market as low as the 1.2050 level, and probably even lower than that. However, the 1.25 level could cause a little bit of a bounce from here, but I believe that will only end up being a selling opportunity yet again. In fact, I believe that the 1.28 level above is massively resistive, and that resistant area extends all the way to the 1.30 handle.

The 61.8% Fibonacci level been broken means something

The fact that we broke down below the 1.28 level, which of course was the 61.8% Fibonacci retracement level from the longer-term uptrend suggests to me that we are going to go much lower, and eventually make what would be considered to be a “round-trip”, and that’s exactly what I am anticipate in. That would send the market down to the 1.2050 level, and should offer plenty of selling opportunities along the way.

I believe that rallies will continue to be sold, and I also believe that there is a lot of money in selling the Euro overall. This is true not only against the US dollar, but against several of the other currencies around the world. Ultimately, it is not until we break above the 1.30 level that I would even consider buying this market, but to be honest I do not expect that to happen anytime soon.