EUR/USD Signal Update

Yesterday’s signal to go short on bearish price action on the H1 time frame after the first touch of 1.2500 was triggered, with double inside bars breaking down early in yesterday’s New York session. The remaining 75% of the position is nicely in profit by approximately 80 pips, so 75% of what is left should be closed out. We already have the stop loss moved to break even.

Today’s EUR/USD Signals

No signal is given today.

EUR/USD Analysis

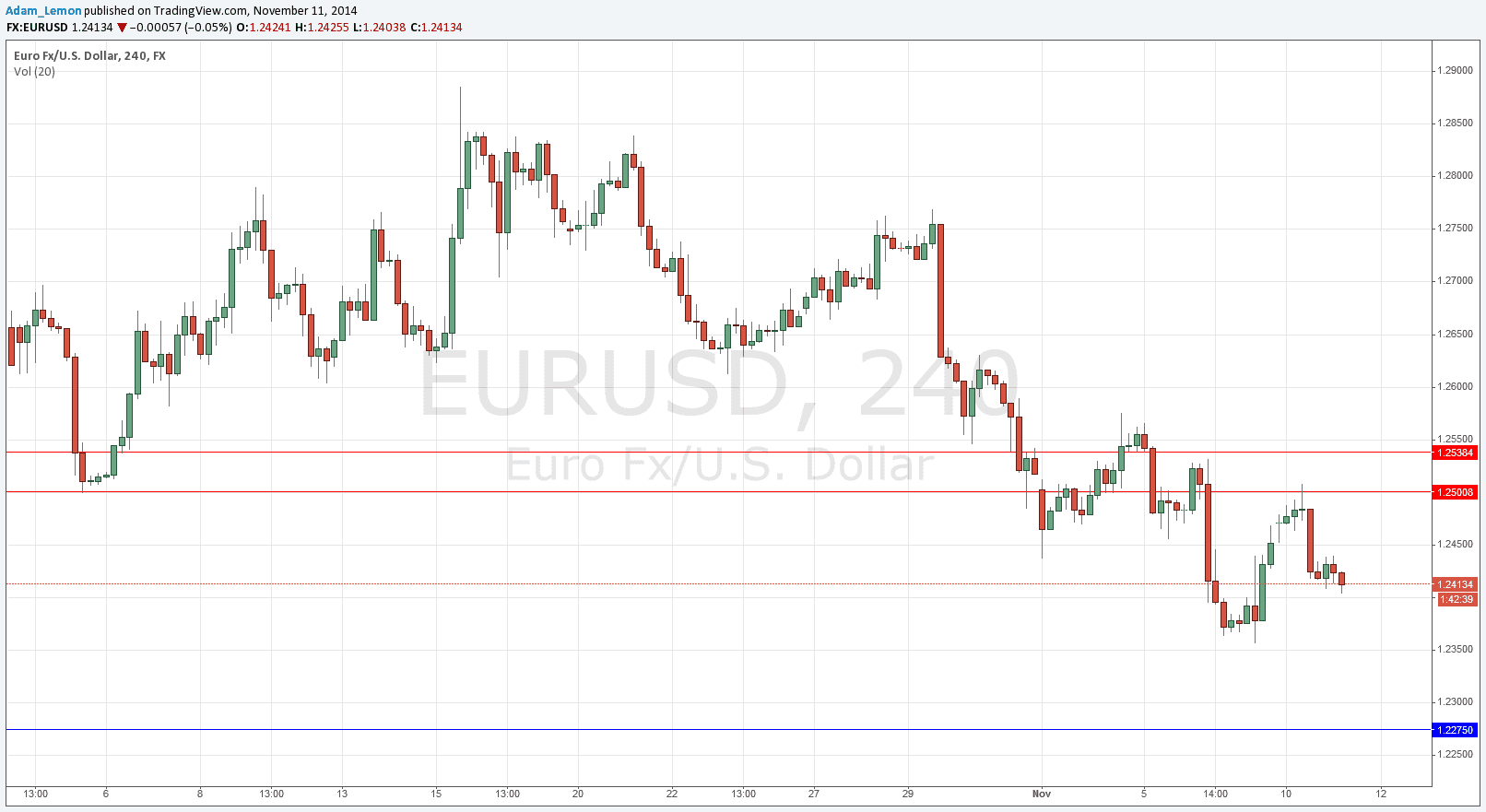

As I expected yesterday, the levels at 1.2500 and 1.2539 would be key in determining the direction of this pair. We were unable to break above 1.2500 during the most active part of yesterday’s session and the New York open saw a renewed strengthening of the USD back in line with the strong long-term trend, which produced a good opportunity for a short-term trade in line with yesterday’s signal.

The EUR is one of the weaker currencies, so this pair did move down with some decent strength and is currently at around 1.2400. The next question is whether last week’s low can be broken.

There are no key flipped support levels below us before 1.2275, so if we can break last week’s low at around 1.2350, there should be nothing to stop us falling further to that price.

Today we are too far from any key levels to look for new trades. We are still holding some of the short position from yesterday as there is a good chance of a further move down over the coming days.

There are no high-impact news releases scheduled today that are likely to affect either the EUR or the USD. It is a public holiday in the USA.