EUR/USD Signal Update

Last Thursday’s signals were not triggered as the price did not reach either 1.2400 or 1.2500 during that day’s London session.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time.

Short Trade 1

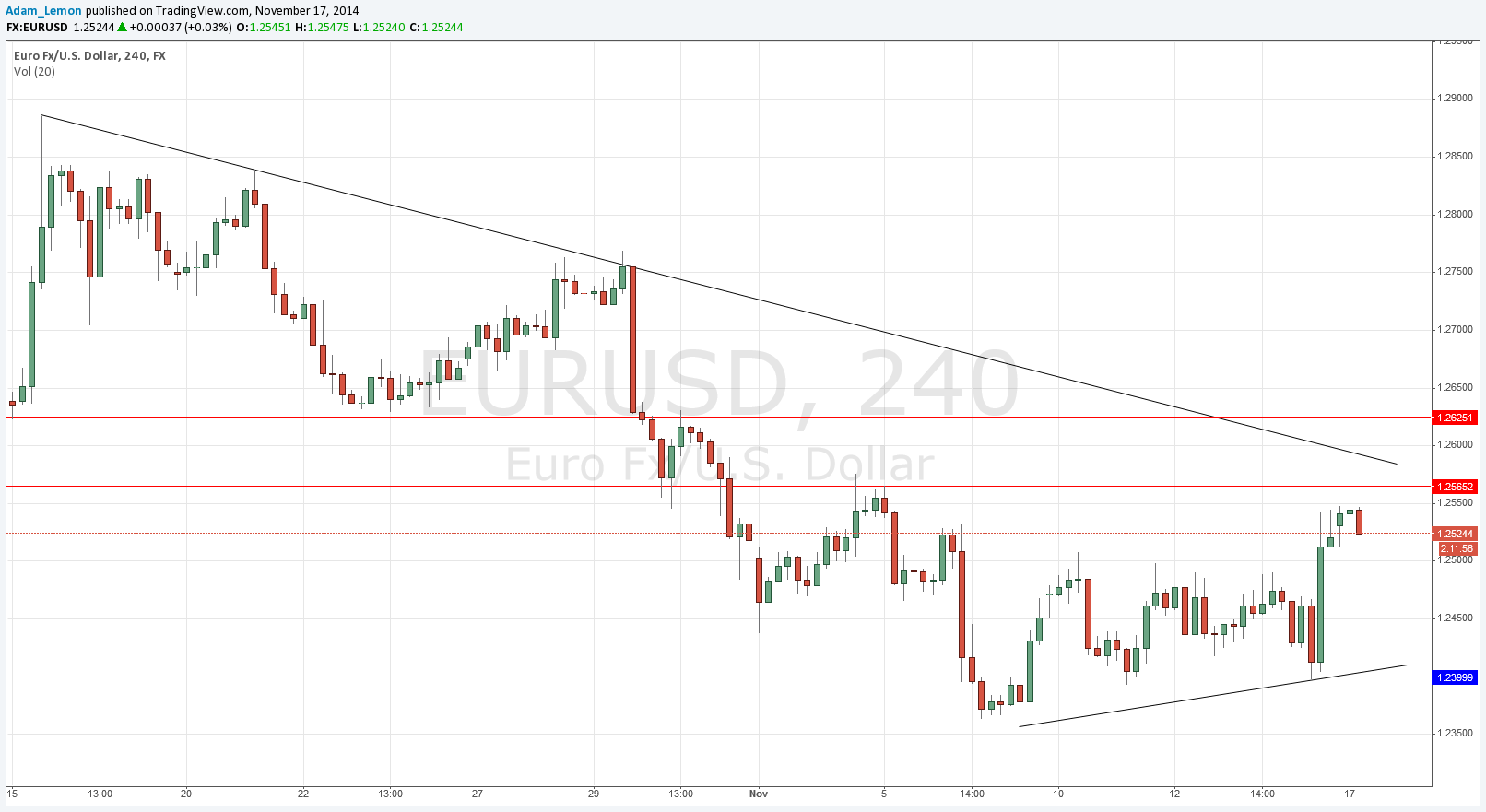

Short entry following bearish price action on the H1 time frame immediately following the next touch of 1.2625.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately following the next touch of the bullish trend line shown in the chart below, a little above 1.2400.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

The price chopped around last Thursday between 1.2400 and 1.2500, which were the two closest levels I had mentioned were worth watching. Then on Friday, the pair shot up after rejecting the support at 1.2400, breaking and closing above the 1.2500 level. Last night there was a bearish bounce off resistance at 1.2562, and the price has been falling steadily since then.

We are forming a triangle and there is a supportive trend line a little above 1.2400 which would be a logical point for a long entry.

There are no high-impact news releases scheduled today that are likely to affect the USD. Regarding the EUR, the president of the European Central Bank will be speaking at 2pm London time. Therefore the New York session is likely to be more volatile for this pair.