EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trade only between 8am and 5pm London time.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately following the next touch of 1.2562.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following bearish price action on the H1 time frame immediately following the next touch of 1.2625.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Long Trade 1

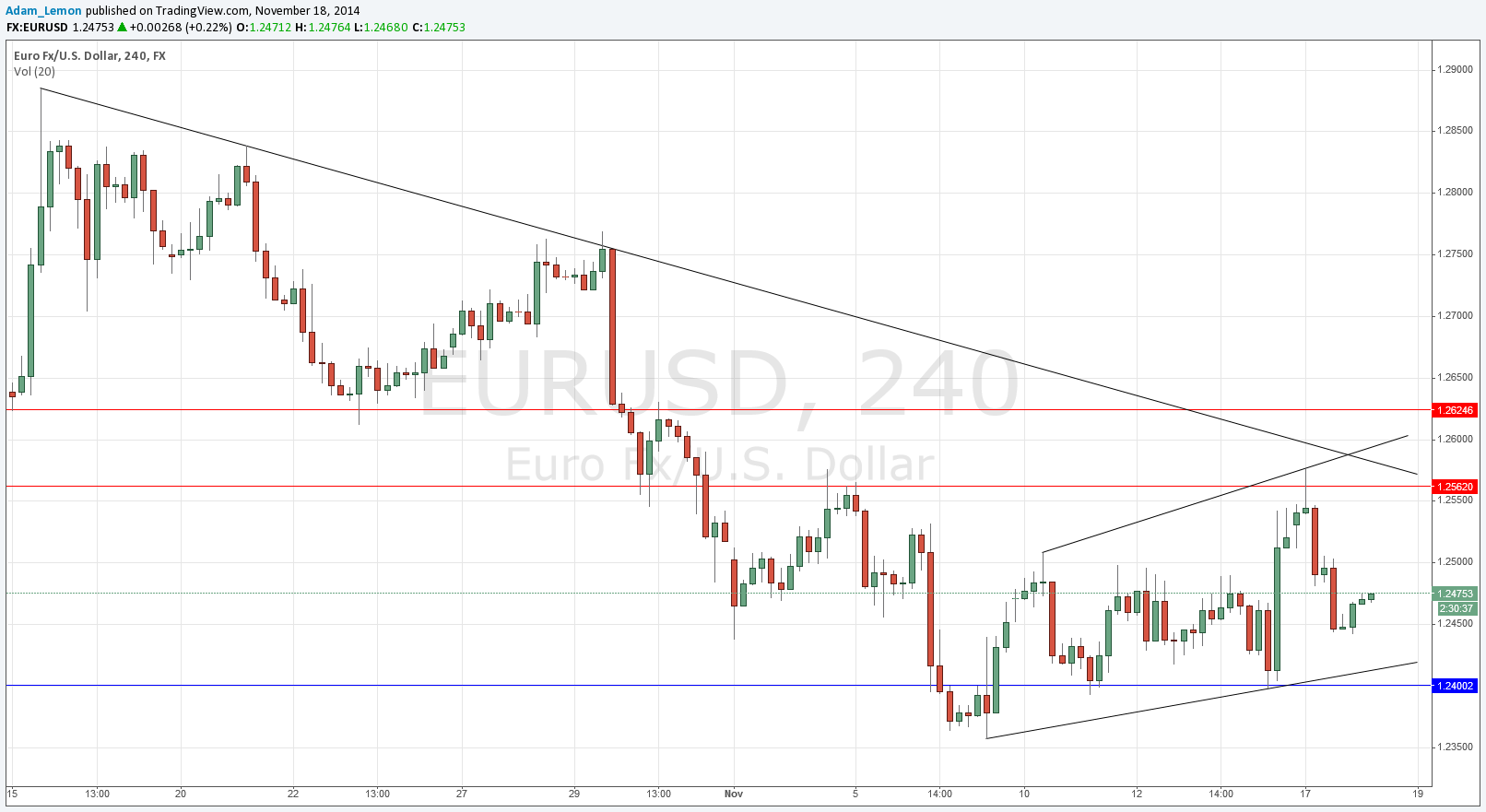

Go long following bullish price action on the H1 time frame immediately following the next touch of the bullish trend line shown in the chart below, a little above 1.2400.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

I wrote yesterday that we are forming a consolidating triangle and over the past 24 hours we have remained within this triangle. The price continued to fall yesterday following its bounce off the resistance I had identified at 1.2562, although the price has been recovering a little over the past few hours.

The pair is still in a strong downwards trend although this has been weakening. We have been forming an ascending channel since last Friday.

There have been no serious technical changes since yesterday and price action rejections of the key levels and trend lines should produce high-probability trades.

There are high-impact news releases scheduled today likely to affect both the EUR and the USD. At 10am London time there will be a release of German ZEW Economic Sentiment data, which is likely to affect the EUR. Later at 1:30pm there will a release of U.S. PPI data, which will probably affect the USD.