EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made prior to 5pm London time.

Risk should be taken off any open trades before 6:30pm London time.

Short Trade 1

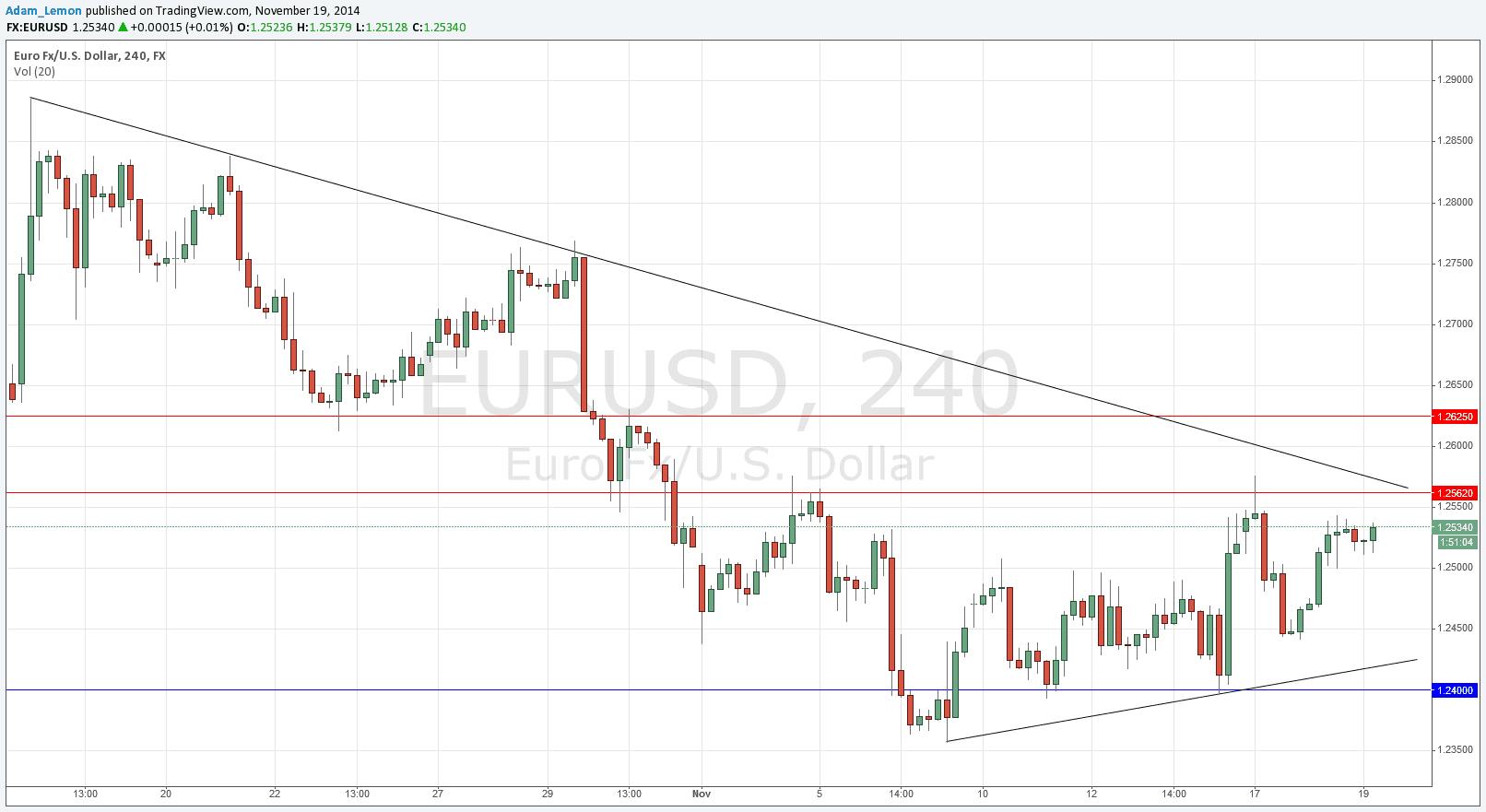

Short entry following bearish price action on the H1 time frame immediately following the next touch of 1.2562.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Short entry following bearish price action on the H1 time frame immediately following the next touch of 1.2625.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately following the next touch of the bullish trend line shown in the chart below, currently sitting at around 1.2420.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

The price moved up yesterday and so we are now approaching fairly close to a horizontal resistance level at 1.2562 and the upper triangle trend line, which may provide a bearish confluence. No key levels or trend lines were hit yesterday.

It is important to note that the EUR has been strengthening against the USD, slowly but surely, and a breakout above the triangle could be a signal that we are in for a period of reversal of the multi-month downwards trend. This could be a big signal for position traders to exit from shorts they have built up over many months, which could provide a sizeable upwards move.

The market is awaiting the FOMC minutes tonight and if there is anything in them that could be seen as bearish for the USD, then a strong upwards breakout might be expected.

Alternatively, either after the announcement or beforehand, we could get a rejection off 1.2562 which would provide the impetus for a renewed move down.

There are no high-impact news releases scheduled today likely to affect the EUR. Regarding the USD, there will be a release of Building Permits data at 1:30pm London time followed later by a release of the FOMC Meeting Minutes at 7pm.