EUR/USD Signal Update

Yesterday’s signals came into play when the price rebounded off 1.2562, but the FOMC statement later caused the price to spike up back past the stop loss, so if profit was not taken very quickly, the trade broke even. The signal did include a recommendation to take the risk off the trade before the FOMC statement.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be made between 8am and 5pm London time.

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately following the next touch of 1.2562.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry following bearish price action on the H1 time frame immediately following the next touch of 1.2625.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

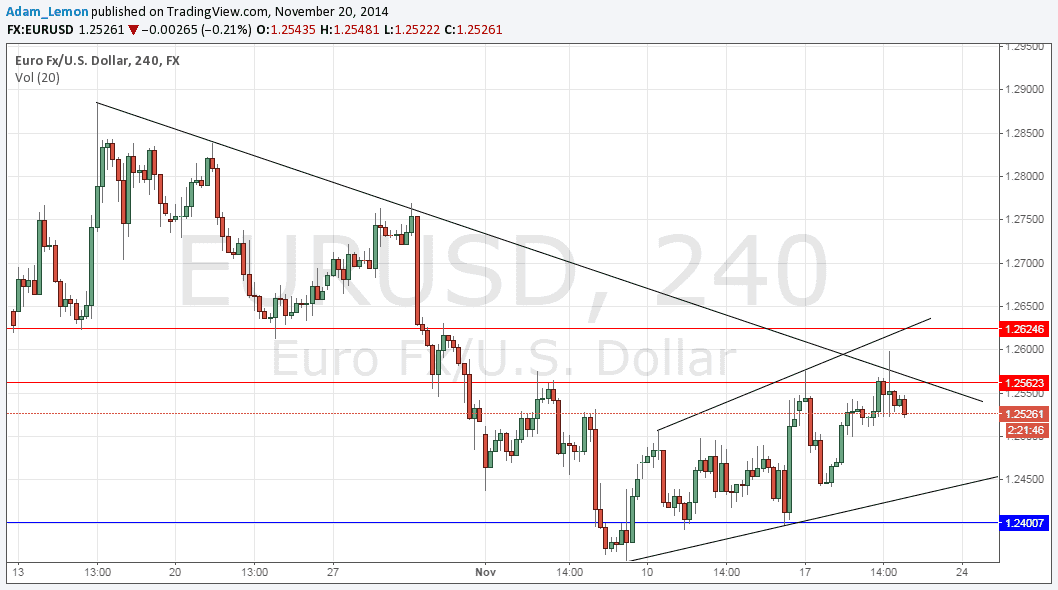

Long entry following bullish price action on the H1 time frame immediately following the next touch of the bullish trend line shown in the chart below, currently sitting at around 1.2435.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

I wrote yesterday that a rejection off the resistance and triangle trend line confluence at around 1.2562 could give us a move down and this did happen before the FOMC statement during the early part of the New York session. However the move was too fast to really take advantage of on the H1 time frame as the price then mean-reverted in the lead-up to the FOMC statement. The statement spiked the price up beyond the triangle trend line, but it was unable to hold there and has falled again to a lower level.

Therefore the triangle and all the key levels we have already been watching are still in play. It suggests there is still a lot of interest out there amongst the big money in shorting this pair when it rises to relatively high prices.

There are high-impact news releases scheduled today likely to affect both the EUR and the USD. At 8am London time there will be a release of French Flash Manufacturing data, followed half an hour later by German Flash Manufacturing. Regarding the USD, there will be releases later, starting at 1:30pm with CPI and Unemployment Claims data, followed by the Philly Fed Manufacturing Index at 3pm.