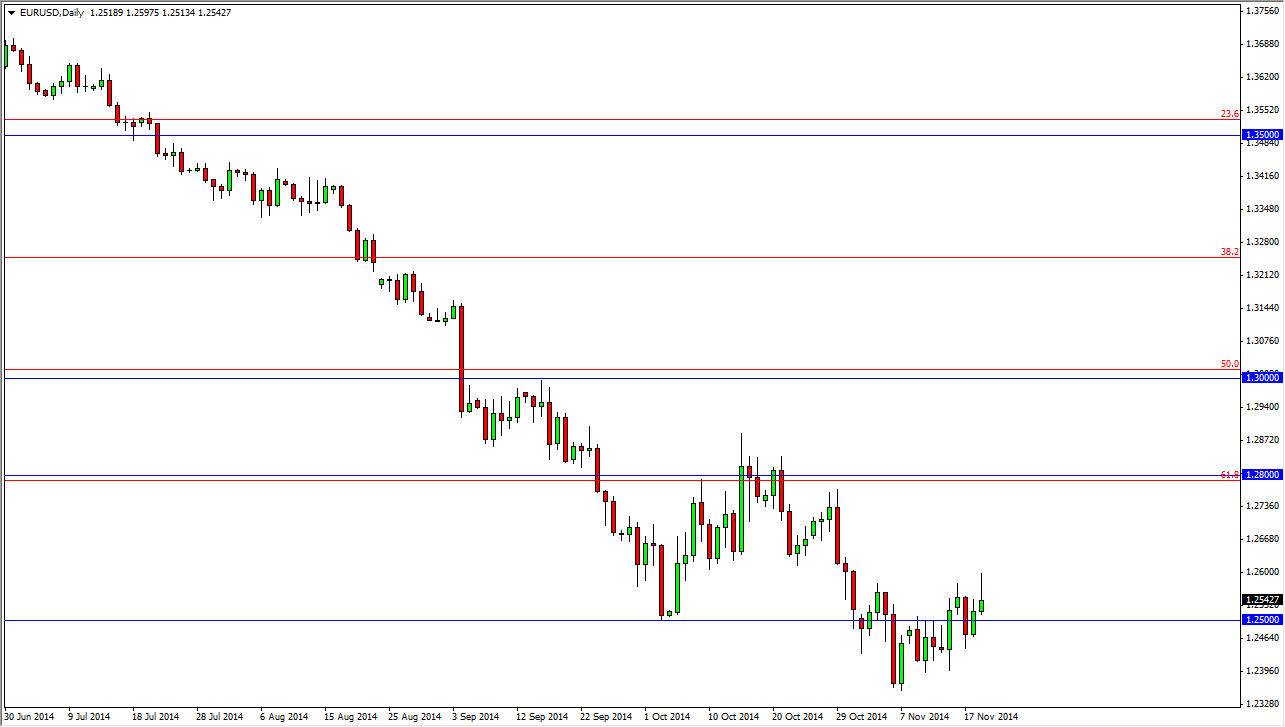

EUR/USD Signal Update

Last Thursday’s signals expired without being triggered as although the price did reach 1.2562 during that day’s London session, there was no bearish breakdown off that price on the H1 chart following the first candlestick.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately following the next touch of the broken lower triangle trend line currently sitting at around 1.2445.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short following bearish price action on the H1 time frame immediately following the next touch of 1.2500.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately following the next touch of 1.2275.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

I wrote last Thursday that there is still a lot of big money shorting this pair and that resistance was intact at around 1.2562 and this was exactly the level that could not be broken and from which we fell sharply last Friday, as we broke very cleanly through the bottom of the descending triangle.

The multi-year low at 1.2356 that was established a few weeks ago has held but the price earlier did reach to within just a few pips of it, and the price has been quietly rising since then. It would not be surprising if we get some kind of pull back today. The nearest opportunity for another good short would probably come at a retest of the broken lower triangle trend line.

At 9am London time there will be a release of German IFO Business Climate data which may affect the EUR. There are no high-impact data releases scheduled today that are directly relevant to the USD.