EUR/USD Signal Update

Yesterday’s signals were not triggered and expired as although the price did reach 1.2442 during the London session, there was no bearish price action there on the H1 chart.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2502.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next touch of 1.2576.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Run 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following bullish price action on the H1 time frame immediately following the next touch of 1.2442.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Run 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

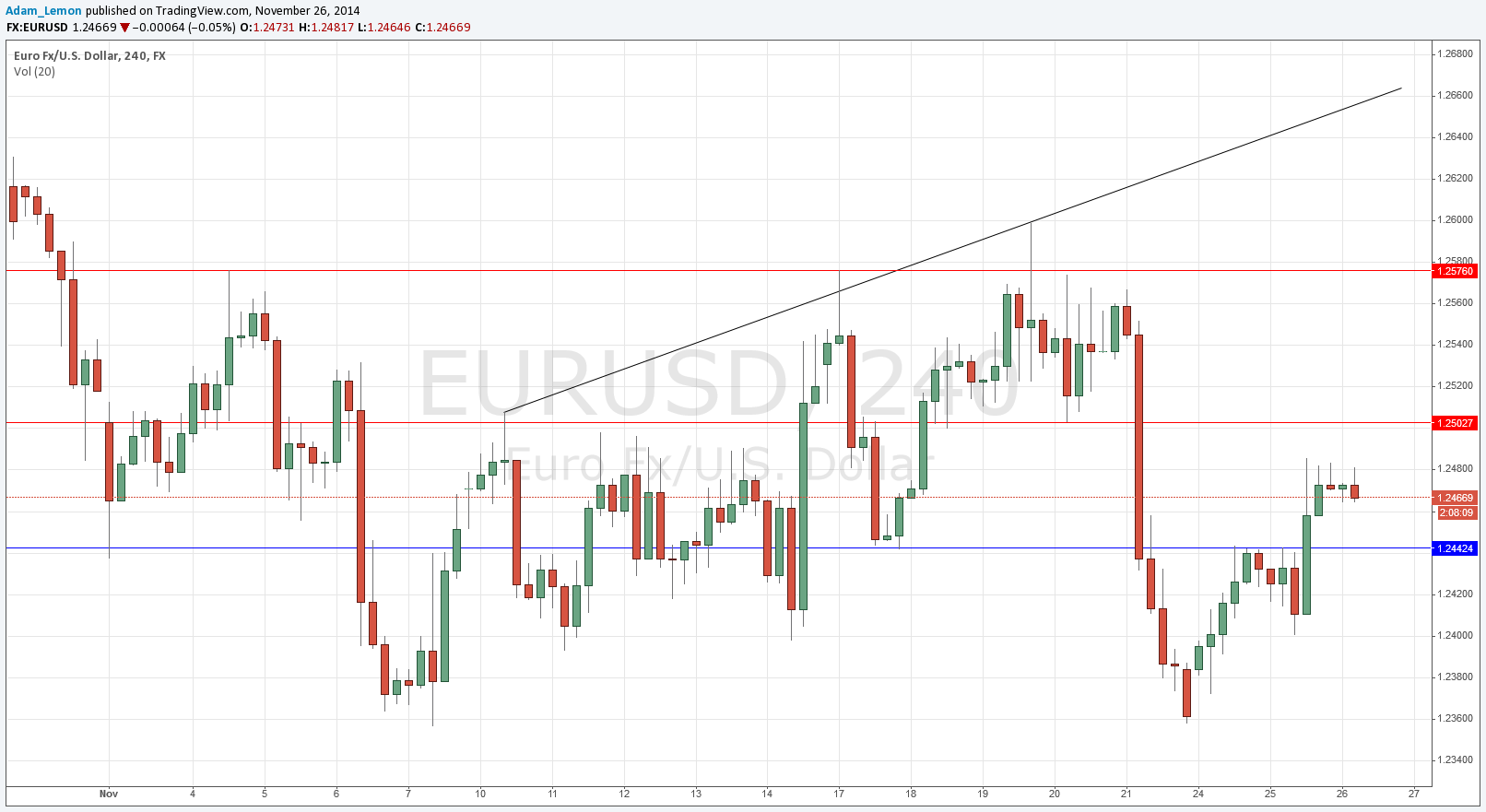

Yesterday we saw a move up which included a break of the lower triangle trend line, so that line can be deleted from our map.

Today seems to be setting up for some more predictable moves, as there is a great flipped level below us at 1.2442 which was previously resistance and both a daily high and low. A breakdown to this level with a quick bullish bounce could be a great opportunity for a long trade.

There is also an inflection level above us just above 1.2500 which is confluent with a key psychological round number, and this could provide resistance.

There is also a resistant area from 1.2576 to about 1.2610 that is also confluent with the area near the ascending bearish trend line.

There are no high-impact data releases scheduled today that will directly affect the EUR. Regarding the USD, at 1:30pm London time there will be a release of Core Durable Goods Orders and Unemployment Claims data. Later at 3pm there will be New Homes Sales data released. The New York session is likely to be more volatile than the earlier London session.