EUR/USD Signal Update

Yesterday’s signals were not triggered and expired as although the price did reach both 1.2442 and 1.2502 during the London session, there was no suitable price action there on the H1 chart after the first touches of these levels.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2564.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2616.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately following the next touch of 1.2442.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

I wrote yesterday that “A breakdown to this level (1.2442) with a quick bullish bounce could be a great opportunity for a long trade.” It is rare that you can be completely 100% right in Forex, but this was spot on, it was unfortuante though that the bullish pin bar that then formed on the H1 chart was not broken to the upside on the very next candle as that was my signal for entry.

We then had a move up and it was not really held by 1.2502.

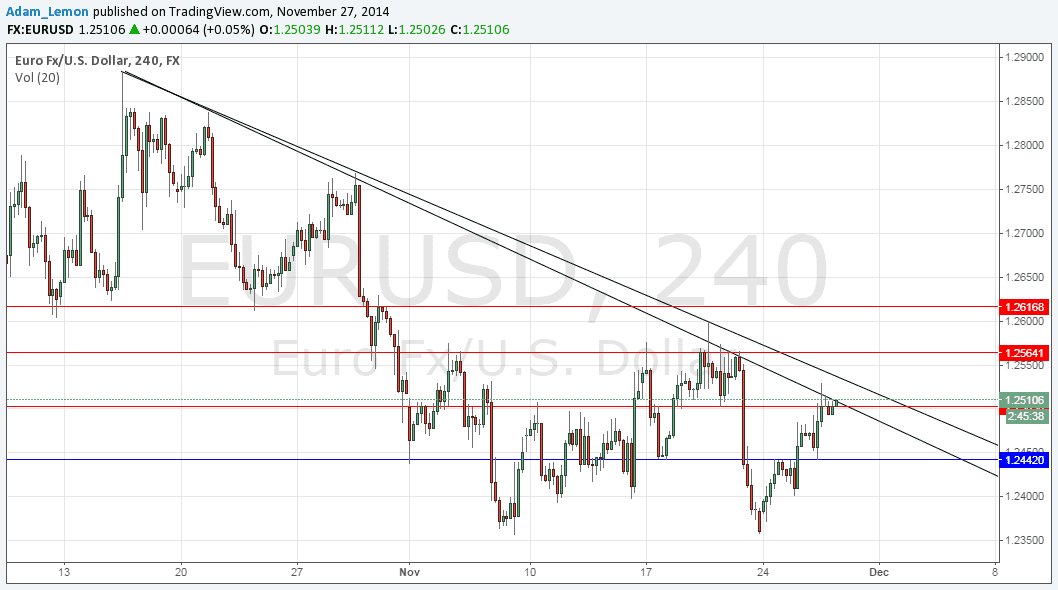

Looking at the chart below, it can be seen that we are bumping up against two medium-term trend lines. The lower one is probably more technically accurate.

If we cannot break these trend lines, we will probably move back down to 1.2442 again, which is now well established as key support.

If we can break out above the trend lines, the next levels of potential key resistance are 1.2564 and 1.2616.

This pair is having a strongly bullish week.

There are no high-impact data releases scheduled today that will directly affect the USD as it is a public holiday in the USA. Regarding the EUR, at some point today German Preliminary CPI data will be released, which might affect the EUR. It is likely to be a relatively quiet day for this pair today.