EUR/USD Signal Update

Yesterday’s signal was not triggered as the price action off the first touch of 1.2500 after London was not sufficiently bearish.

Today’s EUR/USD Signals

Risk 0.75%

Trade before 5pm London time.

Short Trade

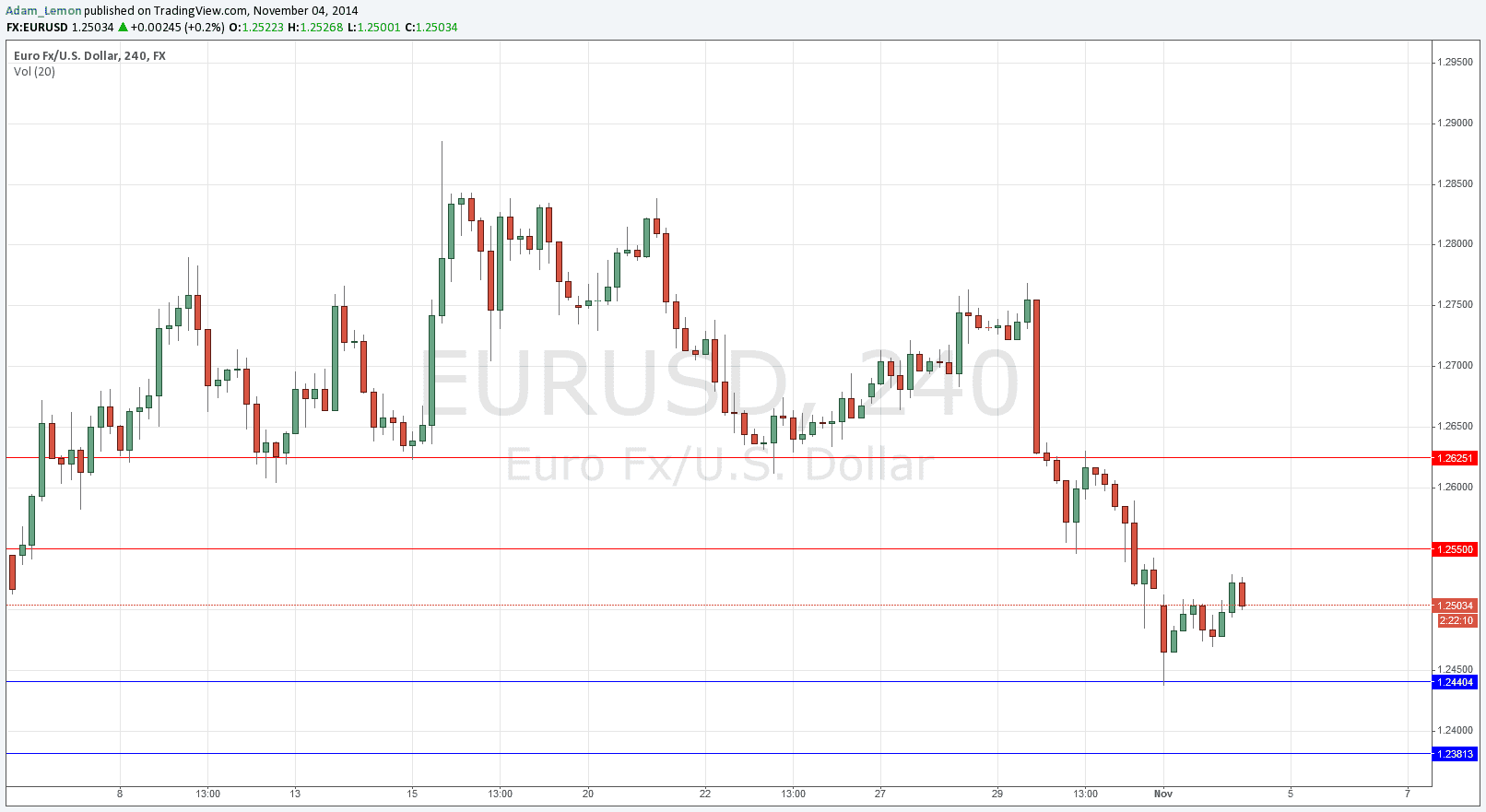

Short entry following bearish price action on the H1 time frame immediately following the next touch of 1.2550.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 25% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade

Long entry following bearish price action on the H1 time frame immediately following the next touch of 1.2440.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 25% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

It had looked as the week opened that resistance at 1.2500 might hold. However this was broken fairly quickly and so far this pair is having a small counter-trend movement up this week.

The next key resistance is at around 1.2550, which might be a good level for the high of the week to be set at, with a resumption of the downwards trend.

Closer examination shows now that resistance from a long time has now flipped to support at 1.2440. Below that there is possible support at 1.2380, but that is a more questionable level.

There is no real sign of the long-term bearish trend ending. My colleague Christopher Lewis sees this pair going down to 1.2050 now that the 1.2500 level has been broken.

At 8am London time today there will be a release of Spanish Unemployment data, which is likely to have an impact upon the EUR. Later at 1:30pm, there will be a release of U.S. Trade Balance data, which is likely to affect the USD.