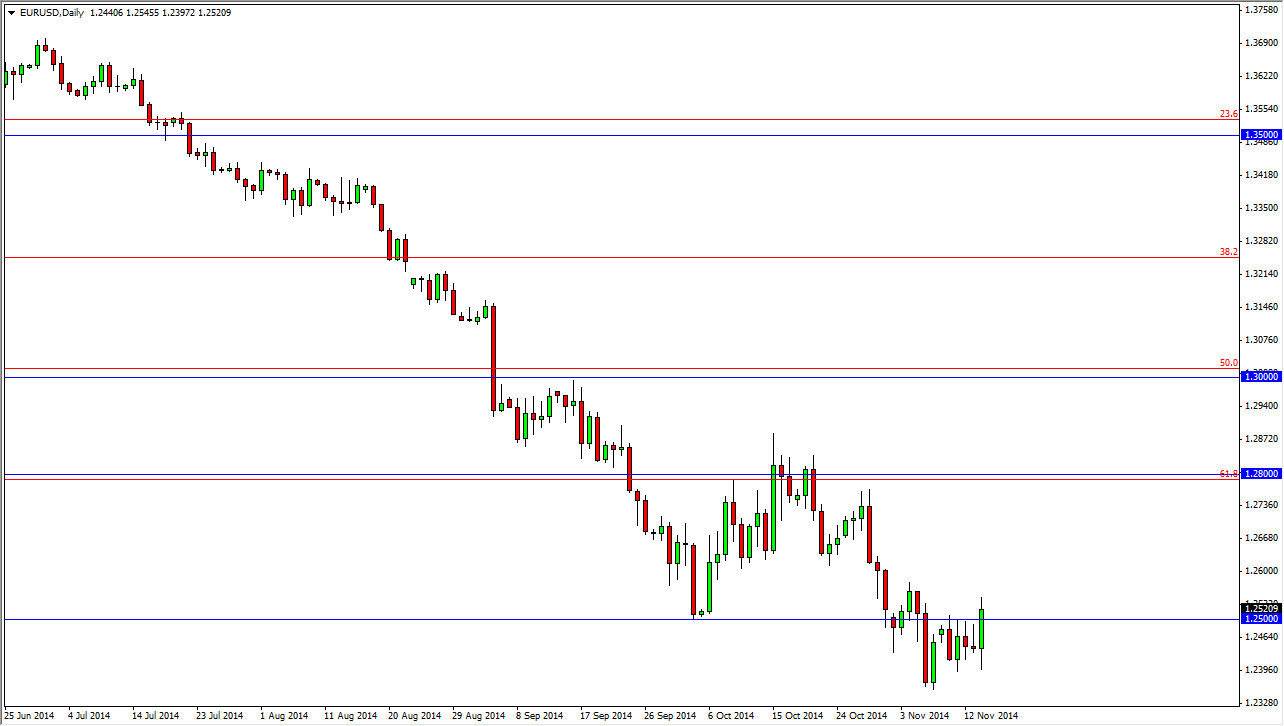

The EUR/USD pair bounced off of the 1.24 level during the session on Friday in order to show a significant amount of strength. We managed to close above the 1.25 level for the session, so that does mean that the buyers could take control for a moment. Nonetheless, I think that there is plenty of resistance between here and the 1.28 level to push the market back down again. With that, a resistant candle would be a selling opportunity as far as I can see. I believe that the market will go much lower, perhaps going all the way down to the 1.2050 level, which was the beginning of the uptrend that we had recently seen in this pair. This is essentially a “round-trip” which isn’t that uncommon when you get a trend change.

European Central Bank

The European Central Bank will almost undoubtedly have to loosen its monetary policy going forward, site have a hard time believing that this market is going to go much higher for any significant time. I believe that the Euro will continue to be soft overall, and that the US dollar will continue to be the favored currency in the longer term. This is because the Federal Reserve has stepped out of the quantitative easing game, something that most central banks can’t say. With that, I believe that we will see a continued move into the US dollar against most currencies, and this pair of course will be any different.

Adding to that weakness is the fact that there are a lot of concerns in Europe about deflation and quite frankly just weak economic conditions overall. I believe that this market will continue to be one that you can sell every time it rallies, but waiting for the right resistive candles will be crucial. I would be stunned to see this market break above the 1.28 handle, so at this point time I have absolutely no interest in buying it as I think that we will continue to see weakness over and over again.