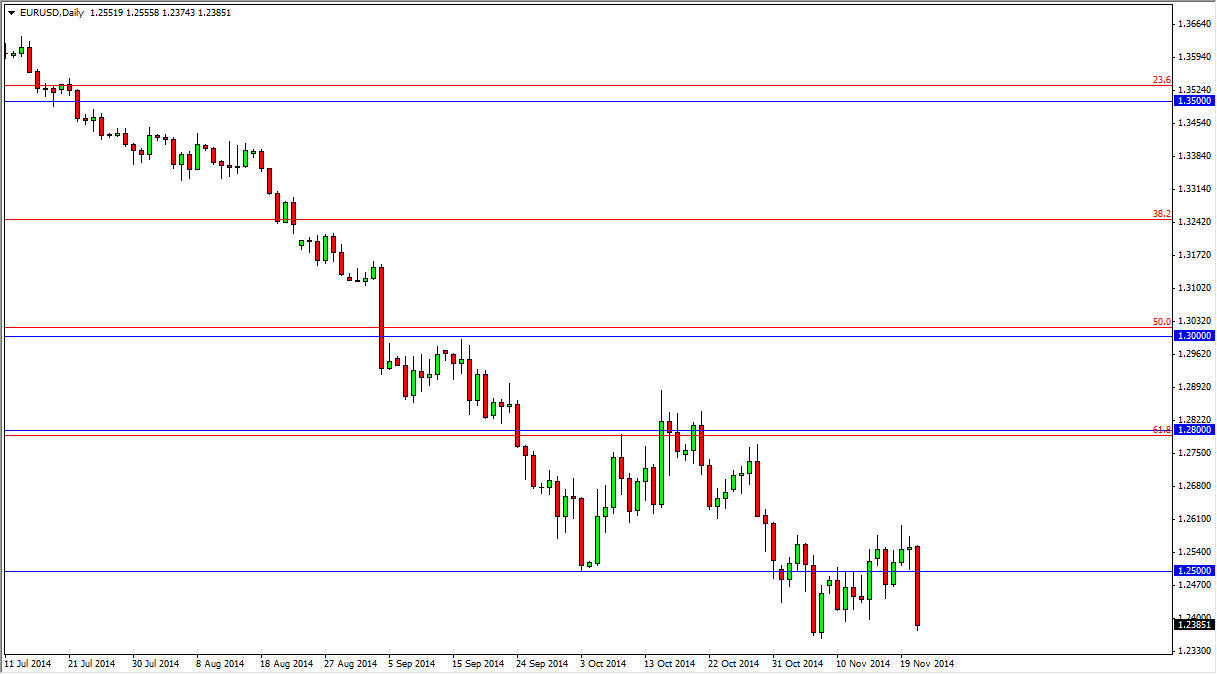

The EUR/USD pair fell rather significantly during the session on Friday as we continue to see massive bearish pressure in this marketplace. I have been advocating for some time selling rallies, and now that we have broken back below the 1.25 level, I feel it’s only a matter time before we go even lower. The candle of course is rather bearish, so that of course means that there should be follow-through as we closed towards the bottom of the range for the day. That being said, I believe that a break down below the 1.2350 level signifies that we are heading into the next leg lower of this massive downward trend.

I think it’s only a matter of time before we do break down overall though, after all, you have to keep in mind that the European Central Bank more than likely will have to keep its monetary policy loose, if not even softer than it currently is. On the other side the Atlantic, we have the Federal Reserve which of course is exiting the quantitative easing game. I don’t necessarily think that the Americans are in a race anytime soon, but we are certainly closer to seeing Americans raising rates than Europeans. And that’s exactly what the Forex markets are based upon, expectations.

Continuation

This is a market that is just screaming that it’s about to continue going lower. It is continuation that I would anticipate seeing, so therefore I have no interest whatsoever in buying this market and I think that every time it bounces it represent value in the US dollar. I don’t like owning the Euro right now, there are simply far too many problems with the European Union and its economy. On the other hand, you have the American economy while not the strongest it’s ever been, it certainly seems to be stronger than Europe, and most of the world in general. Because of that, I think that the US dollar continues to be the favored currency overall, and that of course isn’t going to be any different in this particular Forex pair.