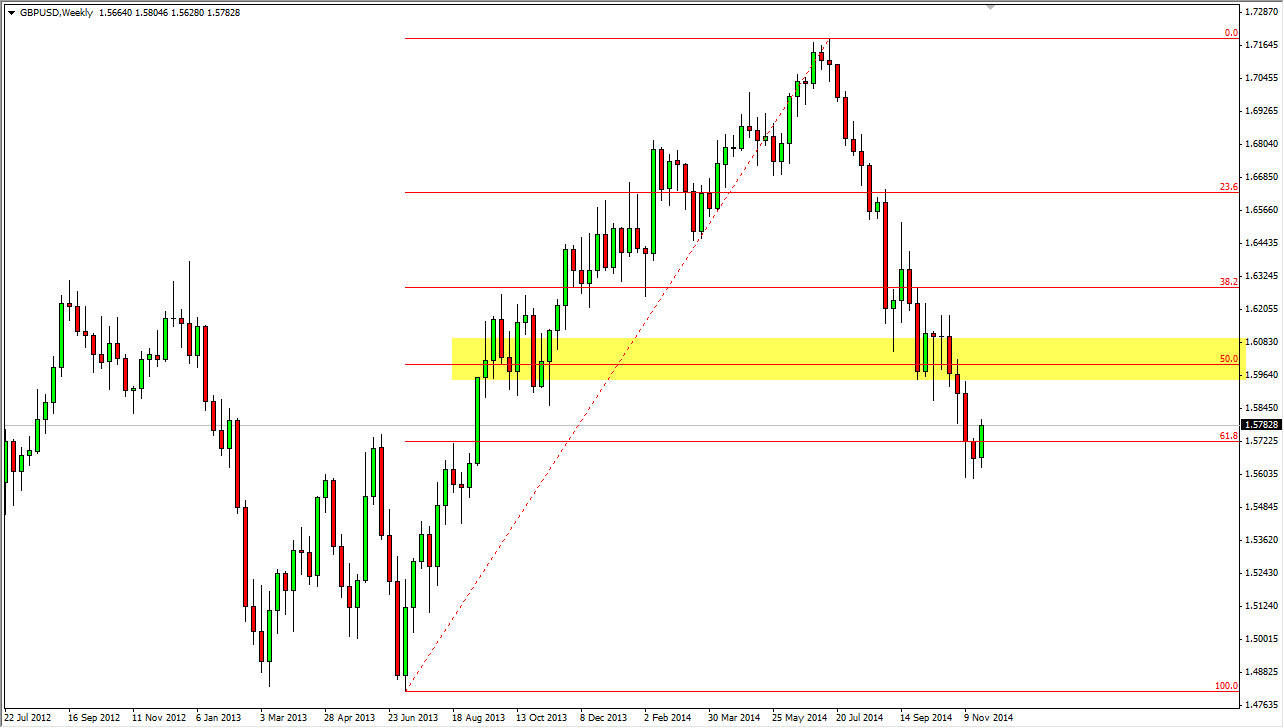

The GBP/USD pair has been falling rather precipitously for some time now, but over the last couple of weeks we have seen the first hints of possible support. Because of this, I am very interested in this pair suddenly, and believe that it might be worth being involved in during the month of December. We have broken the top of a hammer that was placed right at the 61.8% Fibonacci retracement level, which of course is interesting in and of itself.

I have been very bearish of this pair for some time now, by this is essentially the “bottom line” for the uptrend. If we break down below the bottom of the hammer that is centered at the 1.57 level, it’s over. I believe that we go much lower at that point. However, it does look like the buyers are starting to make a stand. With this I believe that we will more than likely head back to the 50% Fibonacci retracement level, which is essentially the same thing as the 1.60 level during the month of December.

Could perhaps be short covering

This doesn’t even necessarily have to be a resumption of the longer-term trend, this could simply be larger traders getting out of the market before the liquidity dries up in order to take profits. Remember, somebody out there placed a lot of money into the market shorting at roughly 1.72, which means there are a lot of profits to take hold. On top of that, money managers will want to perform these closing of trades in order to bring it decent profits to their clients. After all, they are truly profits into you close out the position, so that’s why you see a lot of short covering and position closing towards the end of the year.

With that being the case, I do not think that a move to the 1.60 handle is asking too much during this month. On the other hand, if we do break down below the 1.56 level, I think that the British pound is in serious trouble. However, looking at the British pound against other currencies, I believe that we are about to see a bounce.