GBP/USD Signals Update

Yesterday’s signals expired without being triggered as although the price did reach both 1.5734 nd 1.5789 during the London session, it did not print sufficiently bearish price action on the H1 chart to justify a short trade..

Today’s GBP/USD Signals

Risk 0.75%

Trades must be made before 5pm London time.

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately following the next touch of 1.5944.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately following the next touch of 1.5731.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

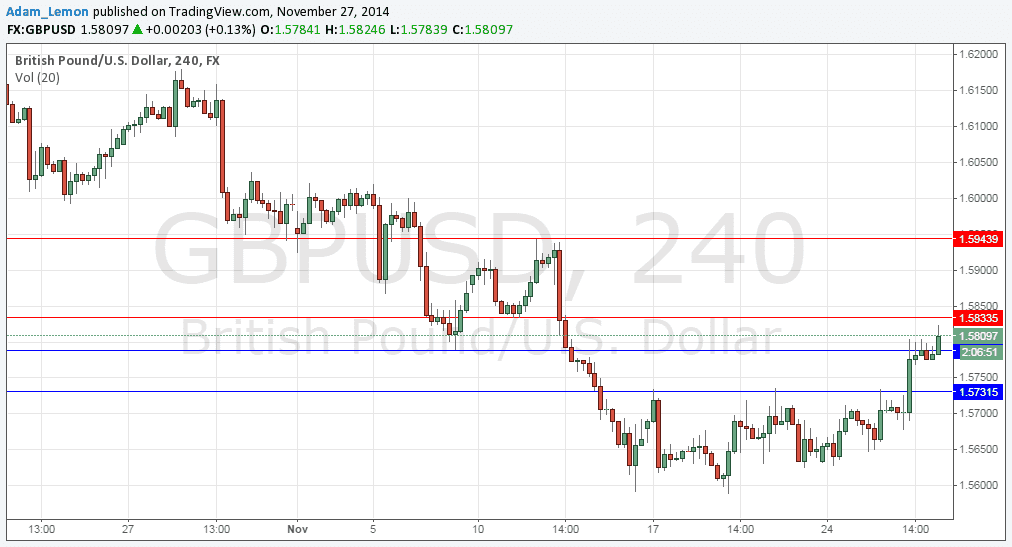

Yesterday's forecast was that a breakout above the triple top at 1.5734 was likely and that the price would rise to 1.5789. This is exactly what happened and in fact the price has exceeded 1.5789 and continued to rise. The level at 1.5734 is now likely to act as flipped resistance to support.

There is local resistance at 1.5833, and after that the way is clear to 1.5933. The level at 1.5789 may also become supportive, but today is probably too soon to seek a long trade from there.

In line with the EUR, the GBP is looking bullish this week.

There are no high-impact data releases scheduled today that will directly affect either the USD or the GBP. It is a public holiday in the USA. It is likely to be a quiet day for this pair today, especially during the second half of the London session.