Gold prices dropped for a fourth-straight session yesterday on growing perception that the Federal Reserve is moving closer to its first rate hike since 2006 after ending a bond-buying program last week. Signs of a steadily improving U.S. economy and weakening Chinese data were also among the factors dulled the safe haven appeal of the precious metal. Last Friday's data from the Commodity Futures Trading Commission (CFTC) had revealed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 100721 contracts, from 107984 a week earlier.

A heavy slate of key economic indicators will be released this week but it seems that the U.S. jobs report will likely set the tone for the American dollar for the rest of the month. If the strong trend in the labor market continues, the market may start to price in new expectations.

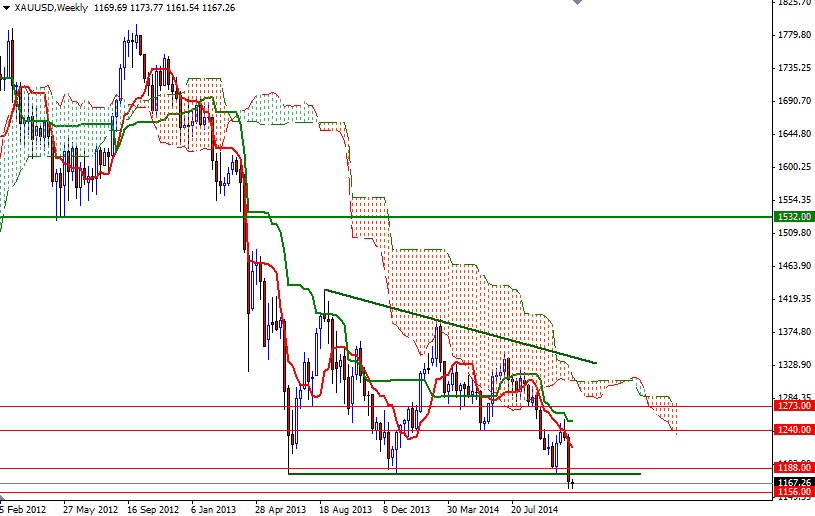

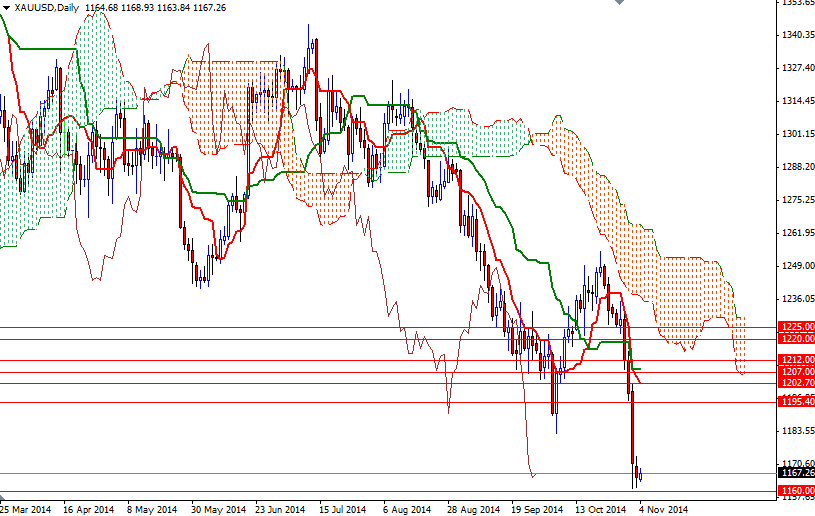

Looking at the charts from a purely technical point of view, I think the last week's candle -which demolished the 1180/3 support zone- confirms that there is still more room to the downside. However, note that the area between the 1160 and 1156 levels may offer some support in the short term. While the market is trading below the Ichimoku clouds on the daily and 4-hour time frames, the bulls will be struggling to regain their strength. Therefore, simply waiting for the market to bounce in order to start selling again is the way to go. If the XAU/USD pair bounces from the current levels, I think resistance will be found at 1174 and 1178. The bears will have to break below 1260 in order to test the support at 1256. If they clear the support at 1256, there is little to slow down their progression until the 1127 level.