Gold prices rose on Tuesday, hitting the highest level since October 31, as the greenback lost some strength ahead of the release of the U.S. Federal Reserve's October meeting minutes, which market players hope will provide further insight into the central bank's assessment of the economy. Given the recent encouraging data, some investors expect the Fed minutes to show optimism about the broader economy. However, inflation continues to run below the Fed’s target and I think that gives policy makers the luxury to keep policy accommodative. Also news that Russia took advantage of cheap gold and boosted its reserves added some support to the market.

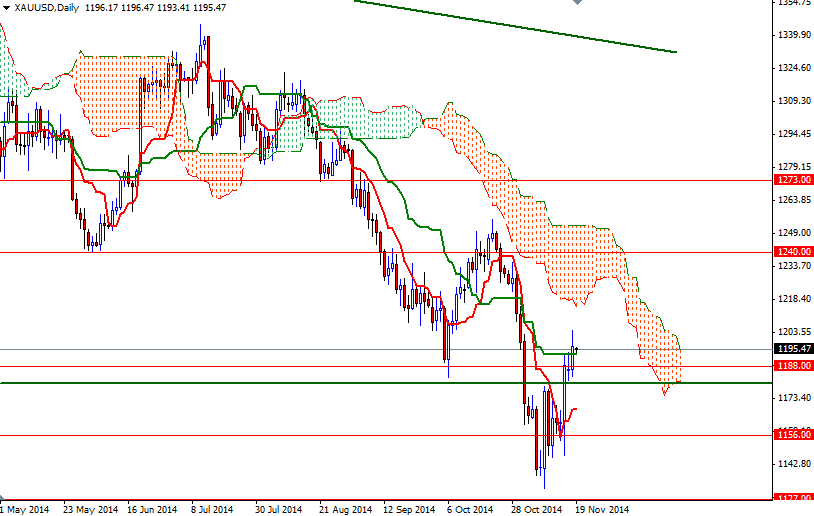

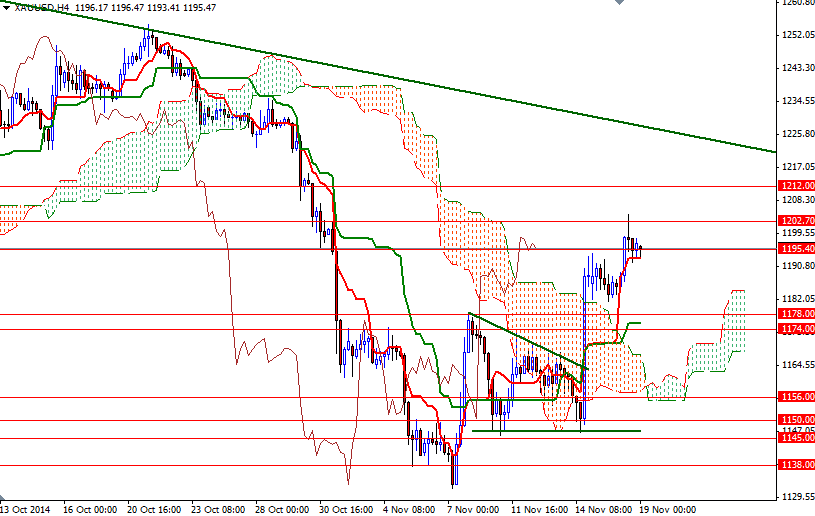

The XAU/USD pair seems to be picking up momentum since hitting a four-and-a-half-year low of $1131.96 on November 7 but I am skeptical on how far prices could go. Although I have been pointing out a positive short-term outlook (possibly targeting the Ichimoku cloud on the daily time frame) recently, there is nothing concrete at this moment to suggest a trend reversal. Technically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. Plus the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-day moving average, green line) lines are still negatively aligned (daily and weekly chart).

Because of that, I think the bulls will struggle to climb above the area between the 1225 and 1240 levels. But of course, in order to go that far, the market has to pass through 1202.70 and 1212 first. If the minutes turn out to be hawkish and prices start to fall, we could go all the way back to the 1178/4 area. The bears will have to shatter this support so that they can take the reins and head towards the next support at 1162.