Gold prices jumped more than 2% on Friday to settle at their highest level in two weeks as weakness in the U.S. dollar spurred demand for the precious metal. Meanwhile, better than expected U.S. data were overshadowed by renewed inflation concerns due to an upturn in oil prices. The Commerce Department reported that retail sales rose 0.3% in October and the University of Michigan's preliminary consumer confidence reading for November came in at 89.4, up from a final reading of 86.9 in October.

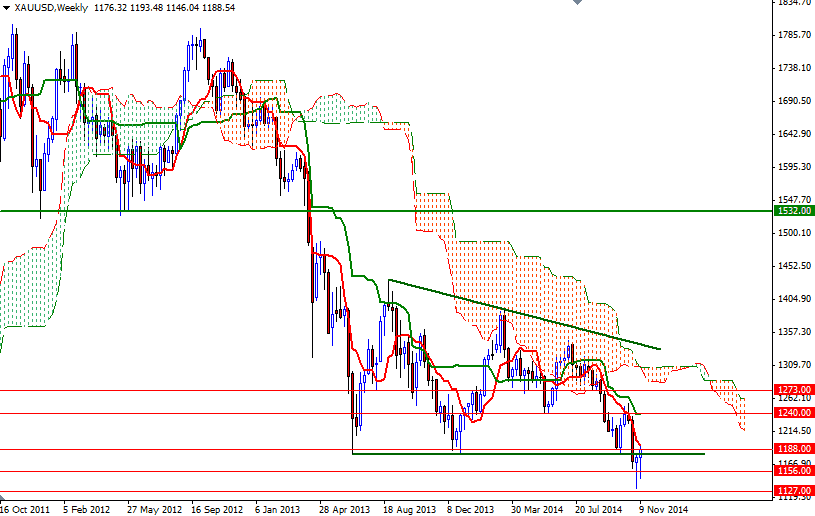

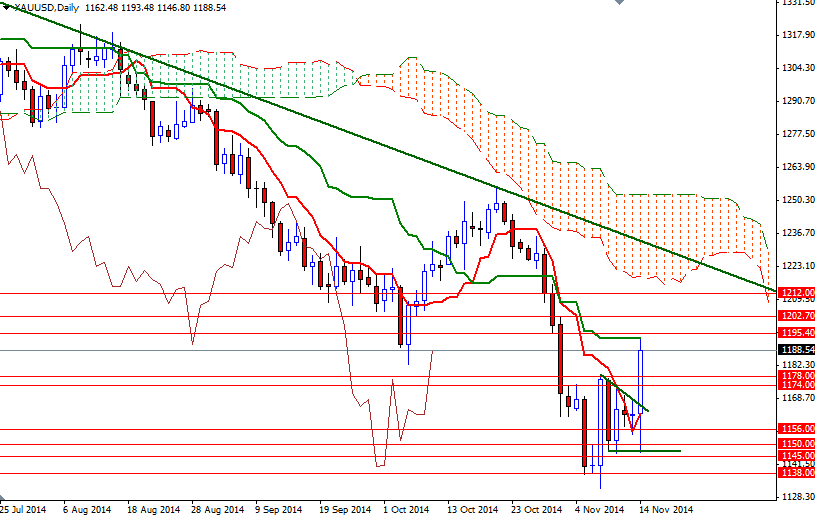

The XAU/USD pair (Gold vs. the American dollar) traded as high as $1193.48 an ounce after the bulls managed to break through the 1178/4 resistance which I had pointed out earlier as a key to higher levels. Although the broader directional bias remains weighted to the downside, the two hammers on the weekly chart and the fact that the market climbed above the Ichimoku cloud on the 4-hour time frame show that lower prices are being rejected.

The pattern on the charts indicate that the market could march towards the 1222 - 1229 area (unless we drop below the November 7 low of 1132, a case that would puts us back on track with such a scenario eying subsequent targets at 1086 and 1062). Since this area (1222 - 1229) converges with the Ichimoku cloud on the daily chart, I think it will be a pretty tough nut to crack and attract serious sellers. On its way up, resistance can be found at 1195.40, 1202 and 1212. However, if the bulls continue to encounter heavy resistance around the 1195 level and prices reverse, we may head back to the 1178/4 area. The bears have to push the XAU/USD pair below 1174 so that they can put more pressure on the market and test the 1165 level.