Gold continued to retreat from a three-week high struck last Friday, as the strength of the dollar helped push the metal down another $7 to $1190. While the greenback gets benefit from the optimism over US growth, the cheapest oil in four years is increasing prospects for a cooling of consumer prices and reducing demand for an inflation hedge. It seems that physical demand will continue providing a temporary floor to gold in the short-term but I think long-term drivers will be the Federal Reserve's plans on interest rates and economic growth.

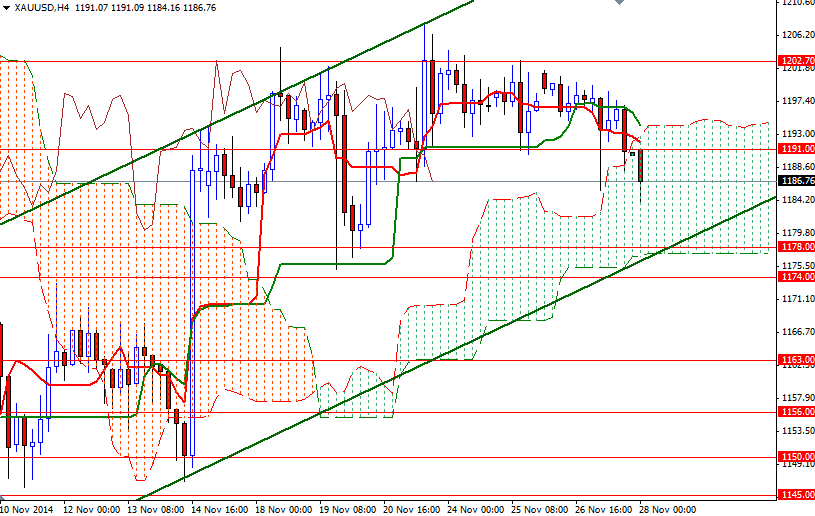

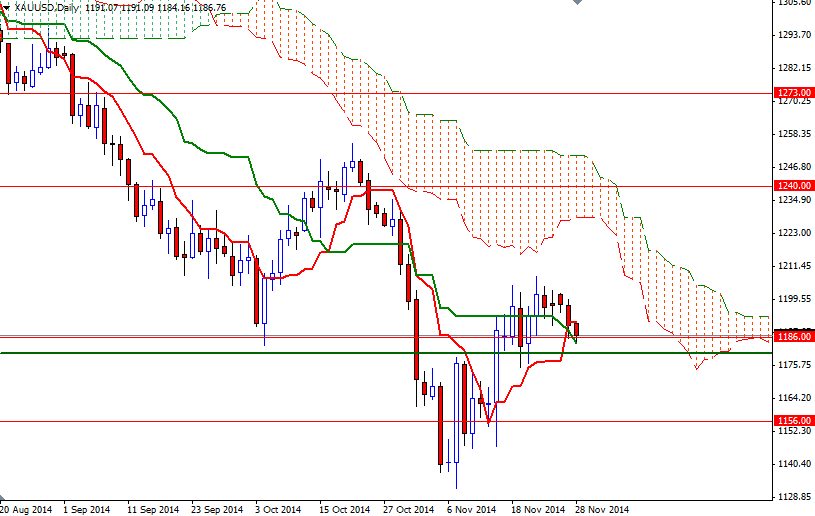

Yesterday's drop dragged the XAU/USD pair back in to the Ichimoku clouds on the 4-hour time frame and that means the market will be range bound for some time, looking for a direction. Technically speaking, the thicker the Ichimoku cloud, the less likely it is that prices will manage a sustained break through it. Trading below the clouds on the daily chart and having a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) on the 4-hour chart makes me think that the market will have a tendency to test the 1178/4 area.

If we break below this support, then the market will probably test the 1166/3 area. closing below 1163 would suggest that the bulls will have to wait a little longer as the bears will be targeting the 1150/4 support next. However, if the bulls gain some strength and push the XAU/USD pair above the 1195 level, then it is entirely possible that we will see the bulls challenging 1203 again. Once beyond that, the market will be targeting 1207 and 1212.