Gold prices closed nearly unchanged yesterday as investors opted to remain on the sidelines following mixed economic reports. In the latest economic data, industrial production came in at -0.1%, slightly below consensus expectations, while the prior print of 1% was revised lower to %0.8. The New York Fed reported that manufacturing in the region jumped to 10.2 from 6.2 a month earlier.

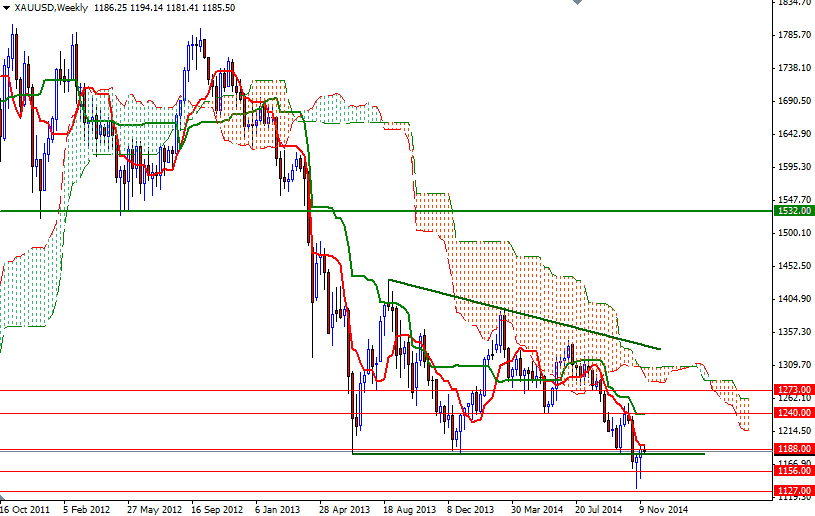

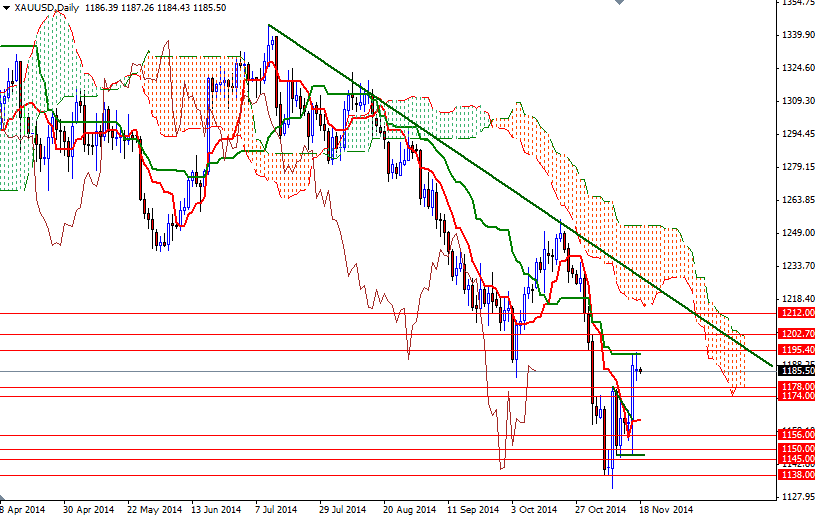

From a technical point of view, both the daily and 4-hour charts are giving mixed signals at the moment. On the 4-hour time frame, the market is trading above the Ichimoku cloud and there is a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross However, on the daily and weekly charts, prices remain below the Ichimoku clouds and there are bearish Tenkan-sen - Kijun-sen crosses. This tells me that the trend is rather bearish in the big picture but there is the possibility of a short-term upswing.

To the upside, the first challenge will be waiting the bulls at 1195.40. If the market breaks through, it is likely that we will see the XAU/USD pair testing the resistances at 1202.70 and 1208/12. Beyond 1212, I see a strong barrier between 1225 and 1240 area and I guess this is where the real fight is going to happen. On the other hand, any failure to shatter 1195.40 might encourage sellers and drag us back to the support at 1178/4. If this support gives way, 1167, 1162 and 1156 will become the next possible targets for the bears to capture.