Gold ended yesterday's trading session almost unchanged, closing at $1197.40 an ounce as the battle between the bulls and bears for supremacy continued in the 1203-1191 battle field. The XAU/USD pair traded as low as $1190.35 after the U.S. Commerce Department reported that gross domestic product advanced at an annualized pace of 3.9% (up from an initial estimate of 3.5) but erased some of earlier losses and touched the $1202.66 level on weaker than expected consumer confidence numbers.

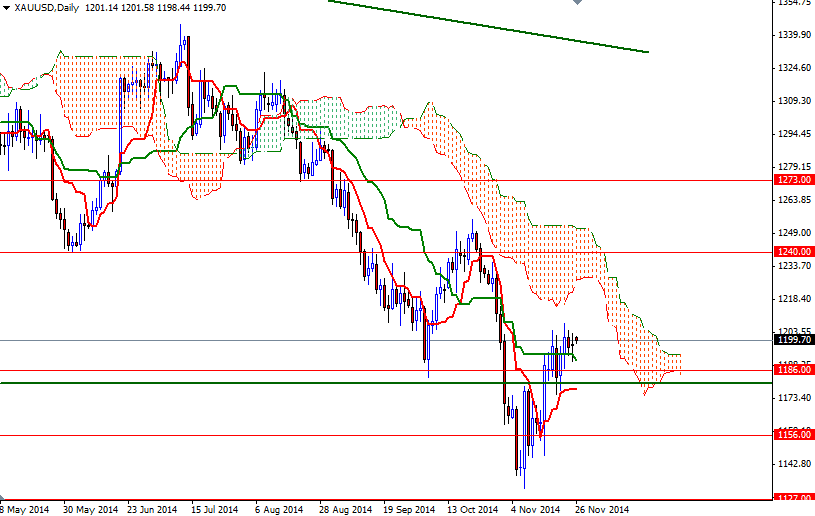

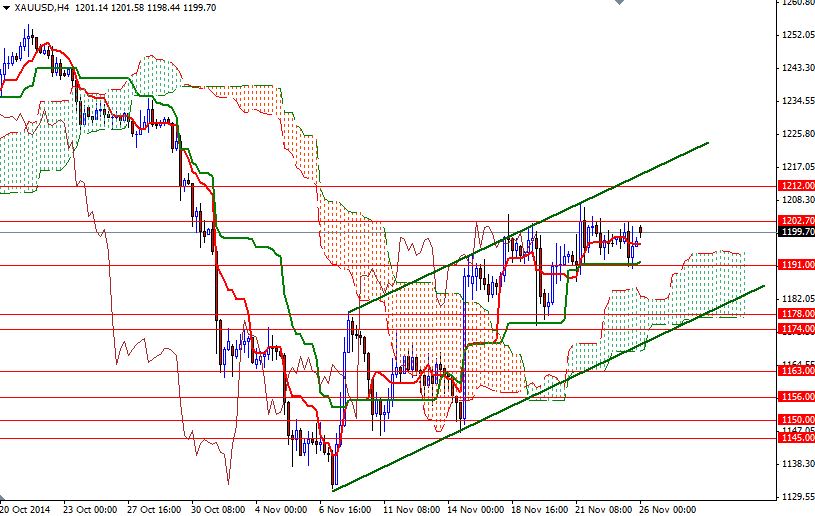

The market has been trapped in a relatively narrow trading range for almost four days and because of that, it makes more sense to wait until we break out of this tight market. On the daily and weekly time frames, prices are below the Ichimoku clouds and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses, indicating that the path of least resistance is to the downside. On the other hand, short term charts tell a different story. Prices are being supported by the clouds below (1-hour and 4-hour charts).

If we finally break above 1203, then we could see a bullish continuation targeting the 1222/5 area. On its way up, there will be speed bumps at 1207 and 1212. The 1240 level above is without a doubt going to be resistive. If prices break below the recent consolidation zone, it is likely that we will see the pair testing the next support levels at 1186 and 1178/4. A break well below the 1174 level could cause prices to dive all the way back to 1163.