Version:1.0 StartHTML:0000000167 EndHTML:0000002690 StartFragment:0000000457 EndFragment:0000002674

The XAU/USD pair closed the day higher after four consecutive days of losses but remained within a tight trading range. Providing an excuse for some short covering in gold was weaker than expected trade balance and factory orders reports. The trade deficit climbed to $43 billion in September from $40 billion in August, according to data from the Commerce Department. The Commerce Department also reported that factory orders dropped 0.6%.

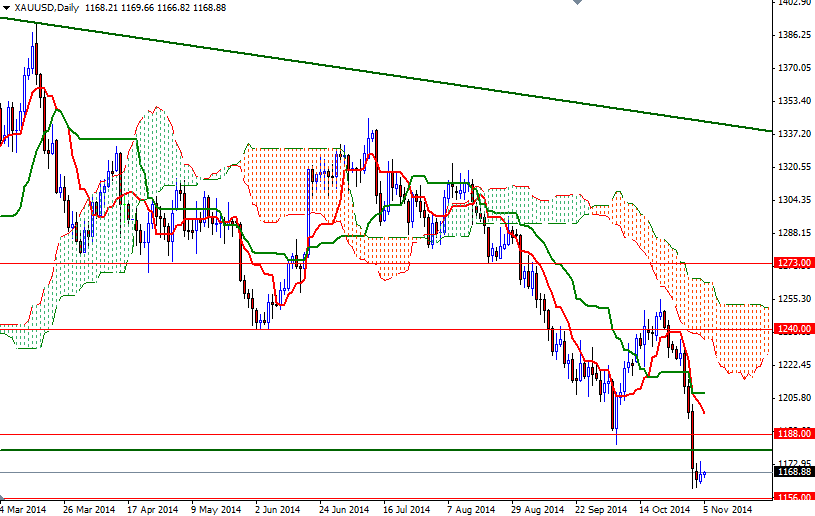

The market has been suffering from strengthening U.S. dollar for months (the downward pressure intensified especially after flare-ups in geopolitical concerns failed to ignite an uptrend) and it appears that the precious metal is heading for its first consecutive annual drop since 1998. From a technical perspective, I think there are a couple of things to pay close attention. First of all, trading below the Ichimoku clouds on both the weekly and daily time frames suggests that the path of least resistance for gold is to the south. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. Second, breaking out of the descending triangle originating in mid-2013 put extra pressure on prices. However, apparently the bearish side of the boat is overcrowded at the moment.

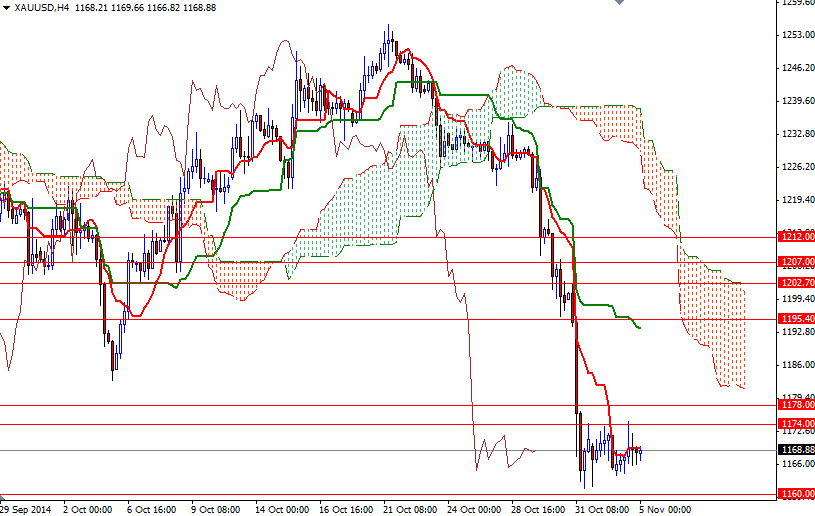

Yesterday's price action indicates that market players will stay sensitive to the news ahead of the U.S. economic data. That means, the recent consolidation between the $1174 and $1160 levels may continue in the near term. If the headlines support the American dollar and the XAU/USD pair takes a dive below the 1160 level, I think the next stop will be 1156. A sustained break below this support would open the doors to the 1145/2 area. The bulls will have to pass through the 1174/8 resistance if they intend to push prices higher and challenge the bears on the next battlefield (1183/8 area).