Although gold prices fell for most of the week, the market scored a gain of 3% on Friday and even challenged the 1178 resistance level. The release of October's non-farm payrolls data was without doubt the major event of the last trading day of the week. The XAU/USD pair (Gold vs. the American dollar) climbed above the 1150 hurdle after the Labor Department said non-farm payrolls increased 214K last month, below economists' expectations for an increase of 235K, while the unemployment rate fell to 5.8%.

The market's reaction to the report suggests that there is exhaustion in selling pressure because the jobs report wasn't bad or weak enough to change the Fed's assessment of the broader economy. However, we cant just look at headline job creation and unemployment rate in order to predict the Federal Reserve's future plans. Another important thing is to look at what’s going on with hourly wages. Average hourly earnings rose 0.1% in October from the prior month. Apparently, recent employment gains haven't been enough to lead into wage pressure and because of that people realize that the first rate hike isn't on the horizon.

Of course, economic expectations are not the only aren't the only factors affecting the market.

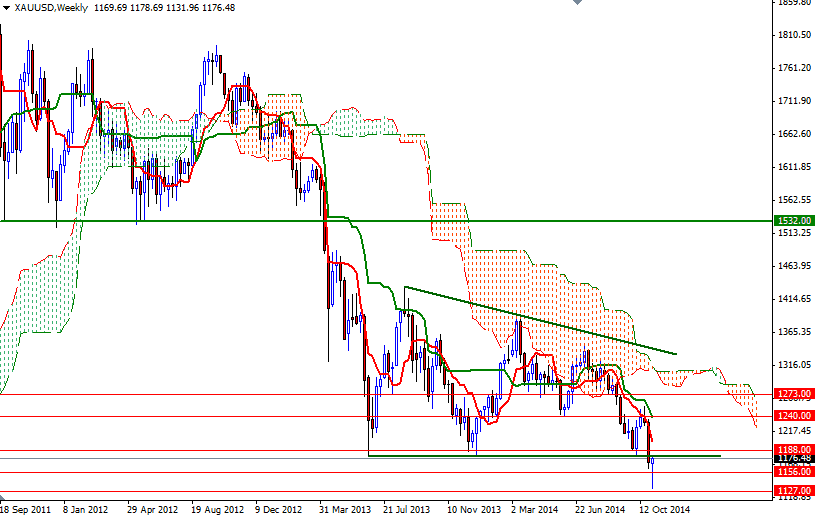

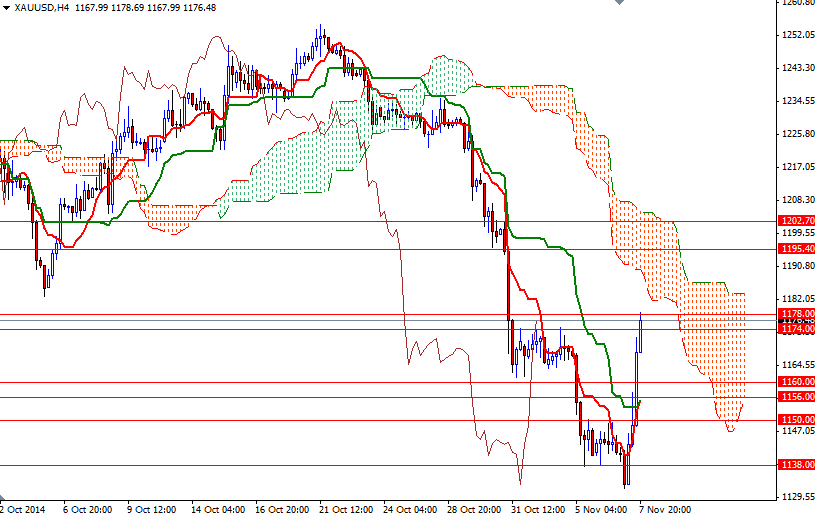

Although there is a growing conviction that the dollar is likely to strengthen, physical demand has picked up recently. The cheapest gold in four years definitely attracted a lot of retail investors to the market. Last week's hammer tells me that perhaps we will try to break above the $1188 level but I would expect gold to come under pressure again later. If the XAU/USD pair climbs above this barrier, it is likely that the market will continue to rise and head towards the Ichimoku clouds on the daily time frame. On its way up, resistance can be found at 1195.40, 1202 and 1212. If the bulls encounter heavy pressure and fail to break through the cloud on the 4-hour chart and prices can go back to test the 1160/4 area. Breaking this support would make me think that 1156 and 1150 could be the next potential targets.